Introduction

Understanding Section 174: Impact on Startups

In the world of startup finance, specific tax rules quietly shape a company’s direction and, by extension, the impact of startups on the broader economy. Section 174 of the Internal Revenue Code has done precisely that. Over the past two years, it has transformed how startups account for research and development costs, influencing not only balance sheets but also the impact of startups on the local economy and innovation ecosystems. What was once a routine deduction has become a strategic matter that affects cash flow, valuation, and investor confidence highlighting how deeply tax policy can shape the influence of start-ups in the local economy.

For startup CFOs and founders, Section 174 is not an obscure technical rule. It is a central piece of tax planning for startups. In my three decades as an operational CFO working with venture-backed companies across industries like SaaS, logistics, gaming, and cybersecurity, I have seen how changes in tax treatment ripple across every part of the business. Section 174 is one of the most significant shifts I have encountered, as it forces leadership to make decisions today that will impact years of future capital planning.

This essay explains what changed, why it matters, and how companies can adapt. I will also share my experience working with professional services that specialize in R&D tax credit studies and provide a practical template to help companies build their own internal framework for tracking Section 174 costs.

What Changed and Why It Matters

Before 2022, companies could immediately deduct their research and experimental expenditures under Section 174. That approach matched the economic reality of innovation: companies spend heavily upfront without immediate revenue, and the tax system allowed those costs to reduce taxable income right away.

The Tax Cuts and Jobs Act changed that landscape. Starting with tax years after December 31, 2021, companies must capitalize and amortize their R&D expenses. Domestic costs are amortized over five years, while foreign costs stretch over fifteen. This means a company that spends $2 million in research and development costs in 2024 can only deduct $200,000 in that year, with the rest spread over time.

The result is higher taxable income, reduced cash flow, and shorter runway. At one SaaS company I supported, the first year of Section 174 compliance created a six-figure tax bill even though the company reported a GAAP loss. That experience was a wake-up call that deferred tax assets and tax strategy must be integrated into startup planning much earlier than most founders realize.

What Costs Are Included Under Section 174

Section 174 covers a much broader range of costs than Section 41, which governs the R&D tax credit. While Section 41 focuses on specific innovation and experimentation activities, Section 174 captures nearly all development costs.

This includes salaries for engineers and technical staff, contractor and offshore development fees, prototype materials, testing equipment, and software licenses. It also includes allocated overhead, such as research facility rent and development-related utilities.

When I worked with a Bay Area technology startup, we initially tracked only salaries. Later, during an audit, the state requested inclusion of contractor fees and allocated rent. That forced us to rebuild our records. The lesson was clear. Section 174 casts a wide net, and accurate compliance requires systems that capture both direct and indirect costs.

The Mechanics of Amortization

The rules require companies to use a mid-year convention. In practice, this means that in the first year of capitalization, only one-tenth of U.S. R&D costs can be deducted, followed by one-fifth in each of the next four years, and the final one-tenth in year six. For foreign expenses, the same formula applies over 15 years.

For example, if a venture-backed company spends $1.5 million in domestic development in 2023, only $150,000 is deductible in 2023. The rest is spread over the next five years. This creates timing mismatches that can force companies to rethink their cash flow models and deferred tax asset schedules.

Why Startups Must Pay Attention

A common misconception is that Section 174 only matters once a company is profitable. In fact, even unprofitable startups may owe taxes because deferred R&D capitalization can flip a GAAP loss into taxable income.

I have worked with companies that suddenly faced state tax liabilities while still incurring significant cash losses. Investors and acquirers now ask specifically about Section 174 compliance during diligence. They want to see evidence that startup CFOs have built accurate models, understand their deferred tax assets, and have integrated tax strategy into capital planning. In one transaction, a buyer required us to provide a detailed R&D study before closing. That study not only protected the company but also preserved its valuation.

Professional Services and R&D Tax Credit Studies

No company should manage Section 174 compliance in isolation. There are professional firms that specialize in R&D tax credit studies and startup compliance. These firms bring together tax experts, engineers, and accountants to create audit-ready documentation.

In my own career, I have partnered with second-tier Bay Area tax firms that delivered deep expertise at a fraction of the cost of larger firms. They provided methodologies for allocating costs, prepared R&D credit claims, and built capitalization schedules for Section 174. One of the best investments we made at BeyondID was commissioning such a study. It not only increased our R&D tax credits under Section 41 but also gave us confidence in our deferred tax asset models.

Systems Thinking and Financial Leadership

I often view financial rules through the lens of systems engineering and complexity theory. Startups operate in chaotic environments where small decisions compound into significant effects. Section 174 is an example of how a minor accounting change can ripple into funding, hiring, and long-term runway.

The companies that succeed treat tax planning as part of their overall system design. This means running multiple scenarios, modeling the impact of each funding round, and coordinating between finance and engineering teams to capture costs correctly. Startups that build these feedback loops reduce the chance of being blindsided.

A Practical Template for Building Your Own R&D Tax Study

Even if you haven’t yet engaged an external firm, you can begin building your own internal framework. Here is a simple template to guide that process.

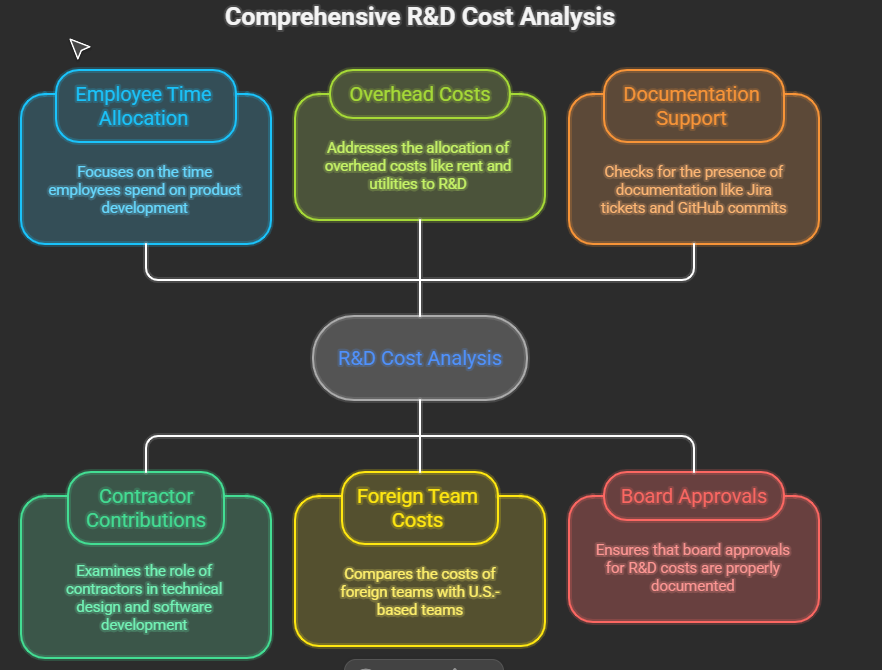

Questions to Ask:

- Which employees spend time on product development, and how much of their time qualifies?

- What contractors contribute to technical design, testing, or software development?

- What overhead costs should be allocated to R&D, such as rent and utilities?

- Are there foreign teams, and how do their costs differ from U.S.-based teams?

- Do we have contemporaneous documentation such as Jira tickets, GitHub commits, or engineering roadmaps to support our claims?

- Are our board approvals for R&D costs properly documented?

Key Issues to Address:

- Classification of expenses in the general ledger.

- Allocation of overhead.

- Documentation of employee activity and project codes.

- Differentiation of U.S. versus foreign costs.

- Preparation of audit defense binders with supporting evidence.

This template will not replace professional study, but it signals discipline to investors, auditors, and acquirers. It also allows startup CFOs to maintain control of compliance while preserving credibility in transactions.

Conclusion

Section 174 is more than a technical tax rule. It is a defining issue in modern startup compliance. It reshapes how research and development costs are reported, affects deferred tax assets, and directly impacts valuation and investor trust.

In my experience, the companies that take Section 174 seriously gain an edge in capital markets. They show that governance is embedded from the beginning, not patched together later. By using professional services, leveraging R&D tax credit studies, and building internal systems, startups can turn compliance into a strategic advantage.

This is not a passing trend. Section 174 is now part of the financial DNA of every venture-backed company. Those who plan proactively will protect their runway, preserve investor confidence, and demonstrate the kind of maturity that buyers and boards reward.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta, CPA, CMA, CIA, brings 25+ years of progressive financial leadership across cybersecurity, SaaS, digital marketing, and manufacturing. Currently VP of Finance at BeyondID, he holds advanced certifications in accounting, data analytics (Georgia Tech), and operations management, with experience implementing revenue operations across global teams and managing over $150M in M&A transactions.