Introduction

Understanding Sales Tax for Startups: A Compliance Guide

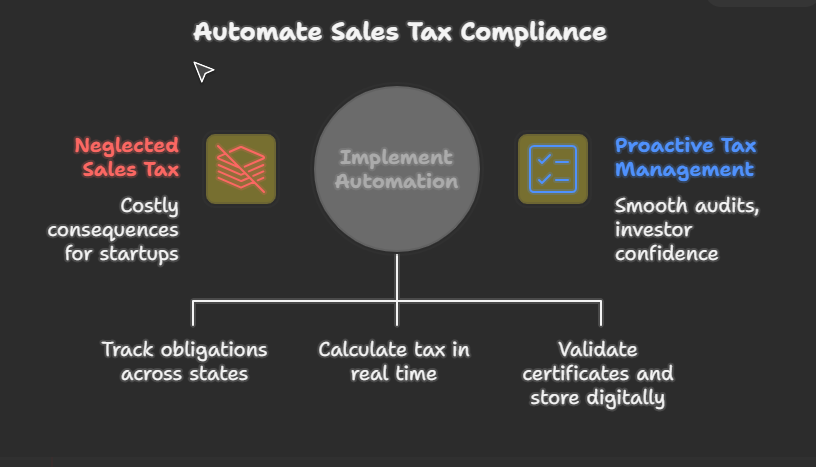

In a startup environment, few topics fall further down the priority list than sales tax compliance. Yet in my three decades of advising and leading startups from Series A through D across industries such as SaaS, cybersecurity, logistics, and e-commerce, I have seen no small number of promising companies blindsided by it’s silent complexity. Sales & use tax compliance may seem like a minor operational detail, but overlooking it can lead to costly consequences. A simple sales tax compliance checklist supported by professional sales tax compliance services can make the difference between smooth audits and painful surprises. In the broader landscape of startup compliance, proactive tax management is not optional; it is a sign of operational maturity that investors quietly look for.

I have experienced this challenge firsthand. At one company I advised, sales tax compliance was neglected during the early stages of expansion. By the time the issue surfaced, we were already selling across multiple states. The mechanics of filing created chaos—different states had different nexus thresholds, taxability rules, and filing requirements. Our finance team spent more time chasing notices than running analyses, always playing catch-up. The distraction was costly—not just in dollars but in credibility with our board and investors.

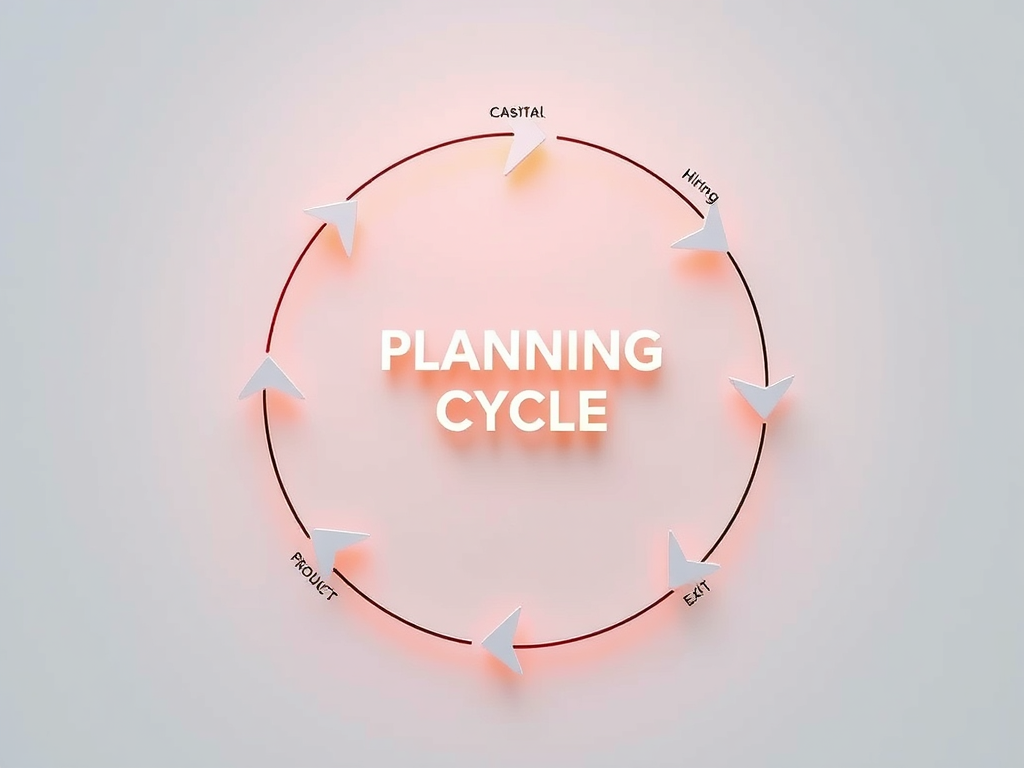

The turning point came when we adopted sales tax automation through Avalara. Automating nexus tracking, real-time calculation, and reseller certificate management transformed compliance from a recurring fire drill into a manageable workflow. Tools like Avalara, TaxJar, and Vertex are no longer optional luxuries. For startups scaling quickly, they are a critical compliance infrastructure. Automation also gave us confidence during M&A due diligence, ensuring that tax exposure would not derail valuation or deal terms.

Sales Tax Is Not Just for Retailers

Sales tax is a transaction tax imposed by states and localities on tangible personal property and, increasingly, digital goods and services. While once reserved for retail, the 2018 Wayfair Supreme Court decision expanded companies’ obligations based solely on economic presence. Suddenly, SaaS platforms, subscription services, and professional firms became subject to sales tax compliance in multiple states.

The result: startups must now master the mechanics of nexus studies, determining where obligations exist—and then assess whether their product or service is taxable in each state. Rules vary widely. Some states tax digital goods, others tax cloud software, while some exempt services entirely. The difficulty is not in paying the tax but in navigating the fractured, inconsistent rules of startup tax compliance.

Use Tax: The Forgotten Companion

While sales tax applies to sales made by the company, use tax obligations apply to purchases made by the company. This flips the burden: when vendors fail to charge tax, startups must self-assess and remit it.

At one of the companies I supported, tax compliance became the Achilles’ heel during an audit. Our subscriptions to cloud tools, equipment purchases, and out-of-state invoices had accumulated untaxed for years. The auditors assessed a six-figure liability, not because we tried to avoid tax, but because our systems never flagged the issue. That experience reinforced a lesson: sales and use tax compliance must be designed into workflows early, not patched later under pressure.

Automation once again helped. By integrating Avalara with our ERP, invoices without tax codes were flagged automatically, ensuring tax obligations were addressed monthly rather than discovered years later.

Reseller Certificates: A Shield, Not a Loophole

Another recurring challenge is managing reseller certificates. These certificates exempt purchases meant for resale, avoiding double taxation. But they are state-specific, must be valid at the time of sale, and require meticulous recordkeeping.

One SaaS company I worked with bundled third-party licenses into its platform but never kept proper certificates. During an audit, the state assessed sales tax on all inbound invoices. The resolution consumed months, legal fees, and credibility.

Automated platforms like Avalara and Vertex now streamline reseller certificate management. At our company, once we automated this process, compliance became seamless. Certificates were validated in real time and stored digitally for audits. This removed manual risks and gave confidence during investor reviews.

Why This Matters Before M&A or Venture Diligence

Tax due diligence is where non-compliance becomes costly. Investors and acquirers perform nexus studies, request transaction-level reports, and probe reseller certificate records. Gaps are rarely ignored. Instead, they are priced into valuation or resolved through escrows.

At one late-stage company, we had to escrow hundreds of thousands of dollars to cover potential sales tax liabilities in six states. The deal was closed, but the valuation haircut dwarfed the cost of proactive compliance. As a CFO, I often remind founders: tax risk is pricing risk. It shapes the perception of earnings quality, governance maturity, and even leadership credibility.

Sales Tax Is Not Optional

In the end, sales and use tax compliance is not discretionary. Companies that ignore it do not save money—they defer risk. The exposure is cumulative, interest-bearing, and most often discovered at the worst possible time.

The companies that win are those that embed sales tax automation early, institutionalize compliance processes, and communicate maturity to boards, investors, and employees. Trust in financial governance rarely makes headlines, but it commands a premium in negotiations.

Startups that understand this will never view sales tax compliance as a burden. They will view it as a strategic advantage—one that protects growth, valuation, and long-term credibility.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta, CPA, CMA, CIA, brings 25+ years of progressive financial leadership across cybersecurity, SaaS, digital marketing, and manufacturing. Currently VP of Finance at BeyondID, he holds advanced certifications in accounting, data analytics (Georgia Tech), and operations management, with experience implementing revenue operations across global teams and managing over $150M in M&A transactions.