Introduction

Transforming M&A with AI: A CFO’s Guide to Winning

By Hindol Datta/ July 11, 2025

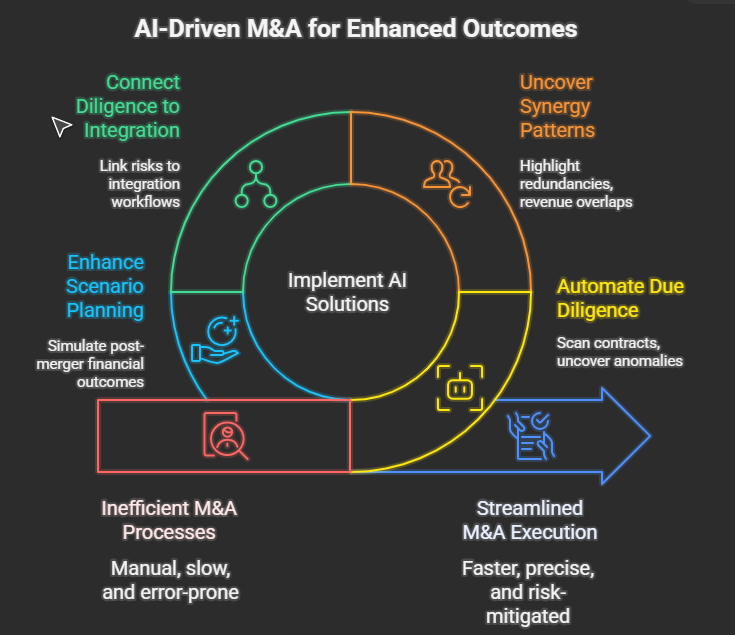

Mergers and acquisitions are often called the proving ground for capital allocation. For CFOs, the real work starts long before the ink dries. In today’s landscape, the rise of AI in M&A is reshaping how we approach both diligence and integration. From AI M&A tools that accelerate risk analysis to M&A AI platforms that surface hidden synergies, the foundation is laid not just in traditional due diligence, but in how intelligently we harness data. And integration planning remains the stage where success or failure is truly determined. Every experienced CFO knows that you don’t win in the boardroom. You win in the data room and again in the first hundred days after close..

Yet winning in M&A has become harder than ever. The amount of data that needs to be analyzed has skyrocketed. Deals are moving faster. Risks are more interconnected. And the pressure to deliver value creation is greater than ever before. Traditional due diligence processes were never designed for this level of speed and complexity. They rely on manual work, fragmented insights, and assumptions that often go stale before the deal is complete. Integration planning faces the same issue: teams relying on spreadsheets, intuition, and “tribal knowledge” instead of coordinated value creation strategies.

This is where artificial intelligence is transforming M&A. The role of AI is not to replace human judgment but to enhance it. By automating repetitive tasks, surfacing hidden risks, and connecting the dots across huge volumes of data, AI gives CFOs an edge. The use of AI in M&A is not futuristic. It’s here now, offering practical applications that improve diligence quality and accelerate integration execution. Having led finance and integration functions across sectors like SaaS, cybersecurity, logistics, and digital media, I have seen the same pattern repeat: deal value is lost not in valuation, but in translation — from data to decision, from diligence to integration.

AI in Due Diligence

At its core, due diligence is about understanding what you’re buying, the risks you’re inheriting, and the upside you can unlock. Traditionally, this meant reviewing thousands of documents, building financial models, and triangulating data across siloed systems. AI compresses this timeline dramatically.

Natural language processing can review hundreds of contracts in minutes, flagging unusual terms, renewal clauses, and hidden obligations. Machine learning can analyze financial data, benchmark it against peers, and highlight irregularities in revenue recognition or expense patterns. AI tools can even scan vendor payments to detect duplicates, fraudulent activity, or cost structures that don’t match market norms. What used to take weeks of manual effort can now be completed in hours, with greater accuracy and consistency.

Customer diligence may be one of the most powerful applications. AI can process CRM data, churn logs, support tickets, and even public sentiment to predict customer loyalty, revenue durability, and concentration risk. Instead of just reviewing top-ten customer reports, CFOs can get a complete picture of the economic engine of the target business. This allows leaders to identify risks and opportunities that would otherwise stay hidden.

AI in Integration Planning

The first hundred days after a deal closes are critical. This is where synergies are either realized or lost. Systems often clash, cultures collide, and timelines slip. Integration planning is essentially a massive coordination challenge, with dozens of workstreams running in parallel. AI helps by simulating timelines, flagging resource conflicts, and learning from past integrations to predict where delays or overruns might occur.

Finance systems integration, one of the most complex areas, can be streamlined with AI. It can analyze ERP structures, propose chart of accounts mappings, and simulate reporting frameworks. Instead of spending weeks on spreadsheets, CFOs can start with an AI-generated roadmap and focus on refinement.

AI also brings value to human capital integration. By comparing compensation structures, job roles, and organization designs, AI can highlight overlaps, gaps, and potential talent risks. It can even use surveys and communication data to assess cultural alignment, helping leaders design organizations that protect key talent while avoiding redundancies.

Synergy tracking is another area where AI shines. AI tools can connect planned synergies to KPIs and financial outcomes, track progress in real time, and flag risks before they snowball. Think of it as a digital project management office that does more than check boxes; it actively measures impact and helps CFOs intervene early.

Building Institutional Knowledge with AI

One of the hidden challenges in M&A is knowledge loss. Lessons from past deals often disappear when team members move on. AI can capture and preserve this institutional knowledge. By learning from historical integrations, it can suggest playbooks tailored to deal size, geography, or industry. For CFOs managing multiple deals or preparing for repeatability, this creates a huge advantage. Here is one thing that we pushed for: added some licenses on Co-Pilot and moved a lot of artifacts into the knowledge source. You can use prompts on the chat to answer queries on Teams. This not only reduces the latency of response but also forces us to build out a living knowledge base.

Governance Still Matters

Of course, AI is not a silver bullet. Success requires strong governance, clean data, and human oversight. CFOs must guide how AI is applied, ensuring outputs are reviewed and strategies remain human-led. AI accelerates work, but it doesn’t replace experience or judgment.

What it does change is the mindset. Traditionally, diligence and integration were viewed as sequential: first analyze, then plan, then execute. With AI, these phases can overlap. CFOs can plan integration while diligence is still underway, test scenarios before the deal closes, and move from risk identification to value creation faster than ever. This compression of time is not just a productivity boost; it’s a strategic advantage.

The Future of Finance Leadership in M&A

Boards and investors know that M&A is often the most extensive discretionary use of capital. They expect rigor, foresight, and flawless execution. CFOs who embrace AI in M&A deliver on these expectations by surfacing risks others miss, validating assumptions with confidence, and translating deal models into operating plans without losing momentum.

The real power of AI in M&A lies in its ability to free finance leaders from the task of chasing data, allowing them to focus on designing value. It will enable CFOs to spend less time reconciling spreadsheets and more time working with business leaders on go-to-market integration, org design, and IT architecture. It positions the finance team not just as gatekeepers of value, but as builders of it.

AI in M&A isn’t about turning diligence into a black box. It’s about making the glass box transparent, fast, and reliable. It empowers CFOs to ask sharper questions, uncover deeper insights, and move with speed and confidence from deal analysis to value creation.

For those ready to lead, the opportunity is enormous. M&A will not slow down. But the winners will not simply be the ones who spend the most or move the fastest. The winners will be those who learn the most from their data and act on it before, during, and after the deal. That is the future of AI-augmented M&A, and it’s a future where finance leaders have the tools to turn bold strategies into real value.

Navigating Deal Valuation with Predictive Analytics

In finance, deal valuation is where uncertainty meets consequence. The numbers inside a valuation model may be built on assumptions and forecasts, but the dollars behind the transaction are very real. Whether you are on the buy side or the sell side, even a slight miscalculation can cause strategic misalignment, cultural friction, and capital misallocation that takes years to fix. During periods of market turbulence or macroeconomic volatility, this risk only becomes greater. For CFOs, finding a more innovative way to approach valuation is critical. We need methods that go beyond traditional discount rates and terminal value mechanics, approaches that adapt quickly and bring risk to the surface early. This is where predictive analytics proves its worth.

Predictive Analytics in Deal Valuation

The idea is not entirely new. Finance leaders have always relied on historical data to guide decision-making. What has changed is the speed, scale, and precision at which predictive analytics now operates. With advanced technology, CFOs can uncover patterns that were once hidden. Signals in customer behavior, pricing shifts, margin trends, and competitive pressures can now be easily surfaced. Predictive analytics doesn’t replace valuation judgment; it sharpens it. And when applied effectively, it reshapes how we approach due diligence, pricing strategy, and post-deal integration.

Testing Assumptions with Real-World Data

Every valuation is built on assumptions. Predictive analytics allows CFOs to test these assumptions against real-world performance. Imagine evaluating a software company projecting 20% annual recurring revenue growth. Predictive models can compare this projection against peers with similar product mixes, churn rates, and price points. They highlight whether the assumptions hold water, reveal if specific customer segments are saturated, and flag external factors like IT spending or hiring patterns that could impact results. This is not guesswork; it is a context built on data.

Enhancing Operational Due Diligence

Predictive analytics also strengthens operational diligence. Many deals fail not because of purchase price but due to flawed integration assumptions. A finance team might assume a 15% overhead reduction is achievable. Predictive benchmarking can compare SG&A costs across similar integrations, showing what is realistic versus overly optimistic. The same applies to revenue synergies. If a buyer expects to cross-sell products, predictive analytics can assess historical success rates of comparable strategies, model customer behavior under new pricing, and predict adoption trends. By the time valuation reports reach the board, these risks are already factored in.

Improving Working Capital Models

Working capital is often a deal’s hidden pain point. Predictive analytics gives CFOs a granular view of receivables, payables, and inventory trends across economic cycles. It highlights seasonal variations, cash conversion patterns, and liquidity risks that static balance sheets miss. With this knowledge, finance leaders can negotiate smarter purchase agreements, set more accurate working capital pegs, and avoid last-minute disputes that derail deals.

Modeling Cost of Capital More Accurately

Traditional valuation often applies to a single discount rate across scenarios. Predictive analytics brings nuance by modeling dynamic risk. For example, if a target’s performance is tied to commodity prices, interest rates, or regulations, predictive tools can run simulations that reveal how valuations shift under different macroeconomic outcomes. Machine learning models can also forecast how external variables influence earnings stability, volatility, or free cash flow. Instead of treating risk as a static input, predictive analytics treats it as a living probability model—making valuation outcomes more realistic and reliable.

Leveraging Available Data

Most of the data needed already exists in public comps, ERP and CRM data, macroeconomic trends, and industry benchmarks. The challenge is not data availability but identifying which signals matter most. This is where CFOs must collaborate closely with data scientists and business leaders, ensuring that valuation models reflect the true economics of the business rather than just abstract numbers.

Changing the Cadence of Dealmaking

Predictive analytics also changes how deals are executed. Traditional diligence is a sprint: receive the data room, run models, and present results. Predictive tools enable real-time scenario modeling, allowing for the simultaneous testing of multiple integration paths, macro conditions, or pricing strategies. This speeds up decisions while providing more substantial evidence for governance. Boards are demanding sharper answers, and predictive analytics allow CFOs to deliver with confidence and transparency.

Driving Post-Deal Integration

The role of predictive analytics does not end with deal closure. It becomes the backbone for successful integration. Instead of static budgets, finance teams can build rolling forecasts using live indicators like sales velocity, customer adoption, and retention rates. Potential risks, whether financial or cultural, can be flagged early, allowing leaders to course correct. Predictive analytics, in this sense, evolves into a long-term operating system for value creation.

Balancing Technology with Judgment

While powerful, predictive models are not infallible. They depend on clean, reliable data and must be balanced with human judgment. Predictive analytics show what might happen, not what should happen. The CFO must remain the ultimate decision-maker, weighing strategic fit, cultural alignment, and capital priorities. Predictive analytics is not a replacement; it is a decision accelerator. It enables better questions, sharper analysis, and faster decision-making.

Building a Culture of Analytics in Finance

For predictive analytics to truly reshape M&A strategy, finance teams must embrace a cultural shift. It is not just a tool for data specialists but a mindset for the entire team. Finance leaders must become comfortable with uncertainty, think in terms of probabilities, and evaluate multiple possible outcomes rather than clinging to static cases. This requires not only new tools but also new habits: habits of questioning, testing, and collaboration across finance, strategy, and technology.

Conclusion

The value of a deal lies not in the model itself but in the future cash flows it represents. Predictive analytics empowers CFOs to test those assumptions against broader scenarios of risk and opportunity. It strengthens diligence, improves pricing accuracy, and accelerates integration. Most importantly, it reinforces the essence of good judgment: asking the right questions at the right time.

In today’s fast-paced and unforgiving deal-making environment, the ability to ask sharper questions more quickly is one of the most significant advantages a CFO can have. Predictive analytics provides exactly that advantage, turning valuation from a gamble into a disciplined, data-driven strategy for long-term success.

Hindol Datta, CPA, CMA, CIA, brings 25+ years of progressive financial leadership across cybersecurity, SaaS, digital marketing, and manufacturing. Currently VP of Finance at BeyondID, he holds advanced certifications in accounting, data analytics (Georgia Tech), and operations management, with experience implementing revenue operations across global teams and managing over $150M in M&A transactions.