Introduction

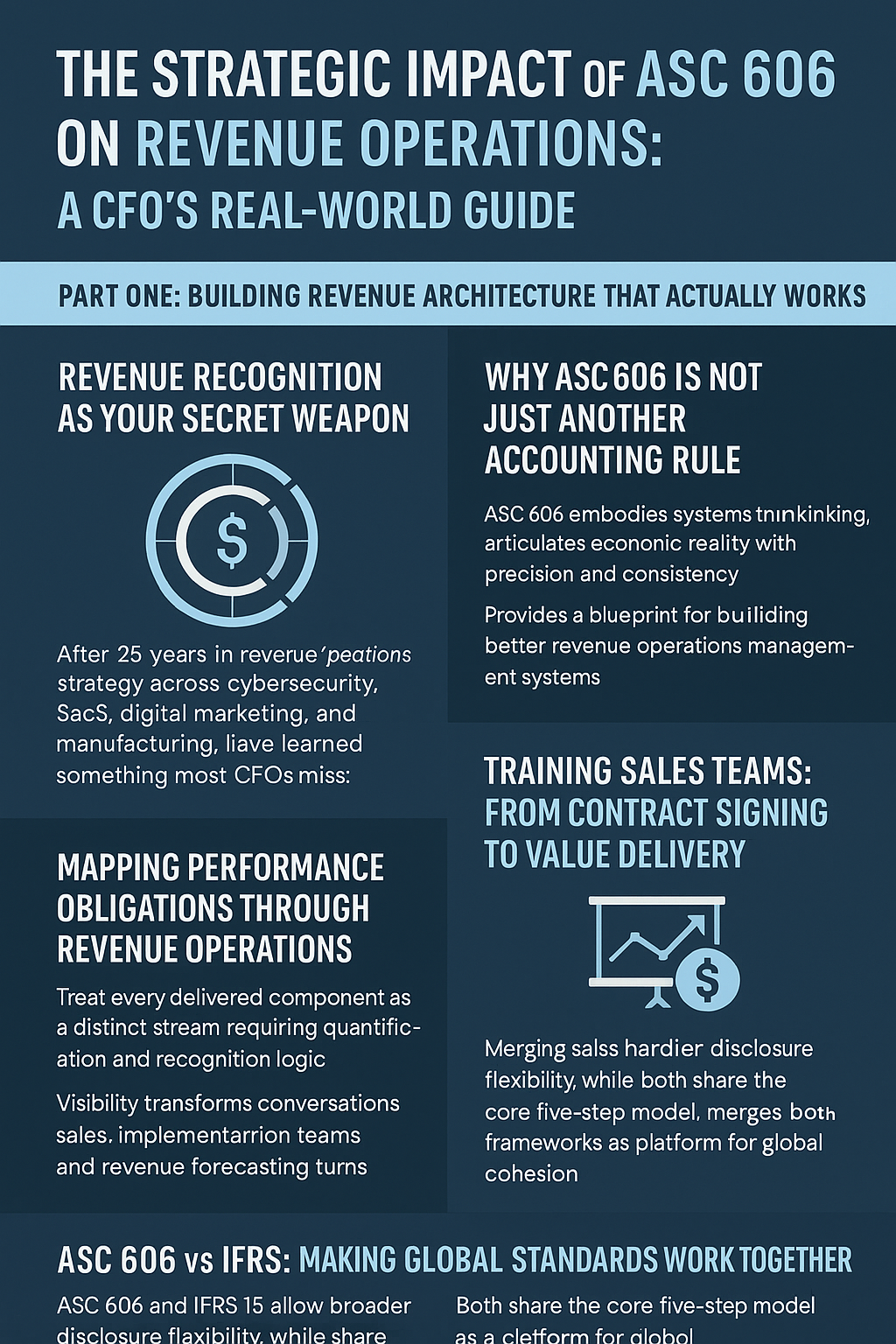

The Strategic Impact of ASC 606 on Revenue Operations: A CFO’s Real-World Guide

Part One: Building Revenue Architecture That Actually Works

Revenue Recognition as Your Secret Weapon

After twenty-five years managing revenue operations strategy across cybersecurity, SaaS, digital marketing, and manufacturing companies, I have learned something most CFOs miss: revenue is not just a P&L line item. In SaaS, especially, concepts like SaaS ASC 606, the nuances of SaaS revenue recognition ASC 606 example cases, and the evolving standards for revenue recognition SaaS under ASC 606 SaaS rules have shown me that revenue is more than accounting compliance. It is the lens through which markets judge our credibility, the map we use to allocate resources, and the foundation that aligns internal incentives with external trust.

During my tenure as CFO at companies like Singularity University and Atari, I watched countless teams treat revenue reporting as an afterthought, something to clean up at quarter-end. But when we started embracing ASC 606 as a strategic framework rather than just another compliance burden, everything changed.

Here is what I discovered: global revenue optimization starts with getting the fundamentals right. And ASC 606, despite its reputation as a complex accounting standard, actually provides the blueprint for building better revenue operations management systems.

Why ASC 606 Is Not Just Another Accounting Rule

Most finance teams groan when ASC 606 comes up. They see it as rules-based complexity that slows things down. But during my years implementing these standards across multiple companies, including my current role as VP of Finance at BeyondID, I have come to see it differently.

ASC 606 embodies systems thinking at its core. It forces us to articulate economic reality with precision and consistency. Think about what it requires: disaggregate revenue by performance obligations, allocate transaction prices based on standalone selling prices, and recognize revenue only as control transfers to customers.

These are not arbitrary accounting gymnastics. They reflect centuries-old business logic: break promises into deliverables, price each component honestly, and record earned value only when you have actually earned it.

In my early finance roles at companies like Coopers & Lybrand and later at GN Resound, we often tracked revenue by invoice date, contract signature, or even cash receipt. These shortcuts hid fundamental misalignments. We double-counted bundled services, buried deferred margin in obscure schedules, and created forecasts that bore little resemblance to actual value delivery.

When ASC 606 arrived, I sensed an opportunity. Not just to comply, but to clarify. To elevate RevOps implementation from order-taking to value architecture. To help delivery teams understand why milestones now mattered as much as timelines.

Mapping Performance Obligations Through Revenue Operations

Within the B2B revenue operations landscape, ASC 606 introduced a crucial discipline: performance obligation mapping. It forced us to treat every delivered component as a distinct stream requiring quantification and recognition logic.

At BeyondID, when we first started mapping software licenses, implementation services, training modules, and ongoing support as separate obligations, our RevOps team was not thrilled. It felt like compliance paperwork that would slow deals down.

But once we redesigned our opportunity stages, CPQ templates, and contract workflows to align with obligation mapping, something interesting happened. We started seeing patterns we had missed before. Bundled discounts were skewing revenue recognition downstream, delaying cash inflows. Training-heavy implementations were creating massive deferral situations. Some “free” setup services were actually disguised discounts that hurt our margins.

This visibility transformed our conversations. Sales teams began discussing margin levers within deals, not just ARR targets. Implementation teams started tying milestone delivery directly to cash collection. Our revenue forecasting now includes deferred revenue curves that reflect reality.

ASC 606 vs IFRS: Making Global Standards Work Together

During my CFO years managing international operations at companies like Atari, teams often asked how ASC 606 differed from IFRS 15. The answer is not in doctrine but in context. IFRS allows broader disclosure flexibility, while ASC focuses on accuracy for public companies. Both share the core five-step model, but diverge on contract modifications, repurchase options, and variable consideration thresholds.

I remember a situation where our European subsidiary wanted different bundled service recognition under IFRS. Their local debt markets valued steady revenue recognition patterns. Instead of creating parallel systems, we insisted on global alignment. We mapped performance obligations identically across regions, adjusted legal language for consistency, and rebuilt our scoring to ensure both ASC and IFRS moved in parallel.

That experience taught me something crucial: accounting frameworks are not adversaries competing for attention. They are dialects in the same language of economic truth. Managing them requires lateral thinking combined with rigorous modeling. We documented decision trees for contract changes, retrained regional RevOps teams to interpret them consistently, and found that compliance became a platform for global cohesion rather than a source of complexity.

Training Sales Teams: From Contract Signing to Value Delivery

One of the biggest post-ASC 606 adjustments was educating our sales operations management teams. Suddenly, deals required more profound thought. Discounts changed recognition timing. Scope changes shifted margin curves. Sales leaders worried this would slow their cadence.

Instead, it improved their conversations with prospects.

When we introduced mandatory performance obligation training for reps at companies like Emerge Digital Group during our hypergrowth phase (when we scaled from $9M to $180M), we did not rely on boring compliance presentations. We contextualized the impact. We showed them that bundled training services recognized over 12 months actually improved customer perception. We demonstrated how strategic pricing improved cash flow timing.

Soon, reps were packaging deals to front-load margin and strategically defer non-critical services. They negotiated based on recognition schedules. They battled objections at an entirely new level. That shift turned compliance into a serious revenue weapon.

Part Two: Building Systems That Scale

Translating Theory into Quote-to-Cash Infrastructure. Once we clarified performance obligations, the real challenge became integration. Theory holds little value if it cannot withstand the daily pace and noise of operations. Drawing on my experience implementing systems at companies like Lifestyle Solutions (where I managed global logistics operations), my first move was not to revamp the general ledger. I walked through our Quote-to-Cash workflow end to end.

I traced where performance obligations got lost, where delivery logic broke down, and where revenue risk hid in plain sight. Most quote templates captured SKUs but not outcomes. CPQ optimization calculated discounts without context. Legal terms protected the company but left room for dangerous ambiguity.

So I redesigned our CPQ schema to align product families with revenue categories. I mandated tagging of each quote line to its respective revenue recognition treatment. I partnered with RevOps to align approval logic with these tags and worked with Legal to ensure contract language mirrored performance language.

This shift did more than clean up data. It illuminated patterns we had been missing. Bundled discounts often skewed revenue recognition downstream. Term-based services bundled with perpetual licenses created deferral landmines. Most importantly, we now had audit trails that explained not just what we sold, but why we earned revenue when we did.

Deal Desk: From Gatekeeper to Revenue Intelligence Hub

To make this sustainable, I had to reimagine our deal desk automation from the ground up. It could no longer just act as a gatekeeper. It needed to become a translator that turned policy into playbook, showing sales teams not just what they could not do, but what they could structure with confidence.

We introduced “red flags” for revenue recognition on deal submission forms. We added automated recognition logic that suggested treatment based on SKU type and delivery timing. Deal desk specialists received scenario-based training grounded in real ASC 606 triggers. Every enablement session started with customer outcomes, not compliance rules.

Over time, sales stopped viewing the deal desk as a bottleneck. They began collaborating early, bringing finance into the conversation to shape offers that optimized both close probability and recognition velocity. When a rep understands how her pricing structure impacts GAAP recognition and renewal runway, she stops selling for the quarter and starts trading for the customer lifecycle.

Forecasting Under ASC 606: From Linear to Layered Intelligence

Revenue reporting automation transforms completely under ASC 606. We can no longer rely on simple linear extrapolation. Instead, we forecast across multiple dimensions: bookings, billings, revenue recognition timing, and cash realization.

Drawing on my data science training at Georgia Tech, I built a forecasting model that layered components. We modeled performance obligation schedules, aligned them to delivery timelines, and mapped revenue waterfalls across quarters. We simulated delays in service implementation and their impact on revenue pacing. We layered discounting by segment and tracked how contract amendments altered the entire waterfall.

This level of sales performance metrics required cross-functional inputs. RevOps provided delivery velocity benchmarks. Legal shared contract amendment timing patterns. FP&A integrated churn scenarios into the models. What we gained in complexity, we repaid in forecasting accuracy. I could now tell the board not just how much revenue we had recognized, but how resilient that number was to execution variations.

Revenue Disaggregation: The Power of Precision Storytelling

The most strategic outcome of ASC 606 lies in disaggregated revenue reporting. This is not a compliance burden. It is a storytelling opportunity that transforms how you communicate value creation.

When we began disaggregating revenue by performance obligation, region, customer cohort, and contract type during my tenure at various companies, we unlocked insights that changed our entire approach. Training revenue was not declining because of poor customer uptake; we were bundling it more aggressively. Support services earned revenue more evenly across cohorts than implementation services, which spiked in the first 60 days. We started correlating each stream to customer lifetime value, margin sustainability, and renewal probability.

This allowed us to rethink our pricing strategy from the ground up. We unbundled key services, framed value in terms of outcomes, and tied renewal logic to prior service performance. Sales collateral evolved. Customer conversations improved. Forecasts began reflecting the real flow of value rather than spreadsheet gymnastics.

When a CFO can demonstrate that deferred revenue matches operational backlog, that stream-level disaggregation maps to strategic positioning, and that recognition cadence reflects genuine delivery timing, you fundamentally shift your company’s relationship with financial truth.

Educating Delivery Teams: Revenue as Fulfillment Reflection. Many finance leaders stop short of engaging delivery teams in ASC 606 education. I took the opposite approach, making sure every professional services manager, onboarding specialist, and customer success lead understood how their execution directly shaped financial timing.

We built dashboards showing the revenue implications of milestone delivery. We celebrated teams not just for completing work, but for enabling revenue realization. We tracked missed delivery SLAs as leading indicators of revenue risk. We held joint reviews with finance and services to align backlog pacing with forecast pacing.

This alignment created unprecedented accountability. Delivery teams stopped viewing finance as a post-mortem function. They saw us as partners in enabling the business to realize what it had earned. That cultural shift across sales, revenue operations automation, and delivery transforms ASC 606 from constraint into catalyst.

Building Cross-Functional Revenue Intelligence

During my experience managing global teams across the US, India, Nepal, and Europe at companies like BeyondID, I learned that cross-functional revenue alignment requires more than just shared dashboards. It requires shared language and shared accountability.

We created revenue recognition scenarios that each team could understand in their context. Sales saw how deal structuring affected quarterly performance. Services understood how delivery timing influenced cash flow. Customer success recognized how expansion timing affected recognition patterns. Marketing learned how campaign attribution is connected to actual revenue realization.

This shared understanding eliminated the finger-pointing that typically occurs when revenue falls short of expectations. Everyone understood their role in the revenue realization process, not just the revenue creation process.

Conclusion: From Accounting Standard to Strategic Foundation

After implementing ASC 606 across multiple companies and industries, from gaming to cybersecurity to digital marketing, I have come to see it not as a burden but as a blueprint. When applied with systems thinking, it elevates your entire revenue operations management architecture.

It aligns revenue recognition with actual value delivery. It forces clarity in pricing and packaging decisions. It dramatically improves forecast signal quality. It builds trust with boards, auditors, and most importantly, customers who see consistent, predictable value realization.

Drawing from my experience as a CPA, CMA, and CIA with over 14 audit cycles under my belt, I believe disaggregated revenue reporting is not just a compliance artifact. It is a lens through which companies can see themselves more clearly. For modern CFOs managing global revenue optimization, that clarity becomes the foundation for every strategic decision that follows.

The companies that treat ASC 606 as merely a compliance exercise will always struggle with revenue operations. Those that embrace it as a strategic framework for B2B revenue operations excellence will find themselves with sustainable competitive advantages in forecasting accuracy, deal structuring, and customer value delivery.

That is the fundamental transformation: moving from reactive revenue reporting to proactive revenue architecture that scales across global operations while maintaining the precision that stakeholders demand.

Hindol Datta, CPA, CMA, CIA, brings 25+ years of progressive financial leadership across cybersecurity, SaaS, digital marketing, and manufacturing. Currently VP of Finance at BeyondID, he holds advanced certifications in accounting, data analytics (Georgia Tech), and operations management, with experience implementing revenue operations across global teams in the US, India, Nepal, and Europe.