Introduction

Mastering 409A Valuation: A Startup’s Essential Guide

In startup finance, few topics generate more quiet anxiety than the 409A valuation. It may not headline pitch decks, drive customer acquisition, or directly attract top-tier talent. Yet, it sits silently behind every equity grant, every option plan, and every founder promise that equity will one day become real wealth. A properly executed 409A valuation report provides a defensible foundation for compensation and protects both the company and its employees from unforeseen tax exposure. When done poorly, however, it can invite compliance issues, investor scrutiny, and significant financial consequences at the worst possible moments.

Over the past three decades, serving as an operational CFO across industries ranging from SaaS and cybersecurity to logistics, gaming, and medical devices, I have come to view the 409A not as a formality, but as a living document—one that must evolve with the business. At Atari, I saw how fast-moving product strategies disrupted traditional compensation planning. At GN ReSound, precision in financial governance was crucial for protecting innovation and global operations. At BeyondID, using Carta as our equity management system, we institutionalized 409A governance into the company’s DNA, ensuring that every grant was tied to precise valuations and audit-readiness. And in my advisory work with organizations like United Way, I have applied the same discipline in governance to nonprofit equity-equivalents, demonstrating that clean systems build credibility everywhere.

The purpose of 409A is deceptively simple: to establish a fair market value for common stock, thereby ensuring that option grants are not issued at a price below market and do not create hidden compensation or deferred tax liabilities. But its implications stretch far further. For founders, executives, and boards, 409A is not merely about compliance. It is about signaling discipline, preparing for investor diligence, and building trust with employees who bet their careers on equity.

Understanding 409A: Why It Exists, What It Protects

The origins of Section 409A of the Internal Revenue Code date back to the early 2000s, following the collapse of Enron. The IRS and Treasury introduced it in 2004 to regulate deferred compensation arrangements and curb the abuse of underpriced stock options. The principle was straightforward: if companies grant stock options below fair market value, they are in effect providing hidden compensation, and such compensation should be taxed immediately with penalties.

For startups, this regulation matters because most early-stage compensation is equity-based. To avoid IRS scrutiny and protect both the company and its employees, every option grant must be issued at or above the fair market value of the underlying common stock on the date of the grant. The 409A valuation is the formal appraisal that supports this pricing.

Companies that lack a current, defensible 409A are exposed. If the IRS determines that options were granted below FMV, it can impose immediate income tax on employees, 20% penalties, and interest dating back to the grant date. For founders and boards, this is not just a tax issue; it is a reputational one.

When to Get a 409A—and How Often

The default rule is that startups should obtain a new 409A valuation every 12 months or whenever a material event occurs. Material events include financing rounds, significant revenue increases, customer acquisition milestones, M&A activity, or changes in capital structure.

Too often, companies wait too long. They assume that because their last round closed at a flat valuation or because revenue hasn’t changed dramatically, they are safe. But the IRS does not grant a grace based on intention. If your company grants options after a financing round and 409A still reflects a pre-money value from a year ago, you are issuing options at a potentially mispriced level. And when that valuation is challenged, either by regulators or during diligence, then there is no room for retroactive correction.

I have advised companies that failed to update their 409A after a bridge round. Six months later, as they prepared for Series B, they discovered that every option issued post-bridge had to be revalued and, in some cases, reissued. This created dilution, employee frustration, and legal risk—all avoidable. At a SaaS company, we avoided this risk by setting an automatic trigger in Carta: any financing event or significant shift in metrics generated a board discussion on 409A. That automation helped embed discipline without creating bureaucratic drag.

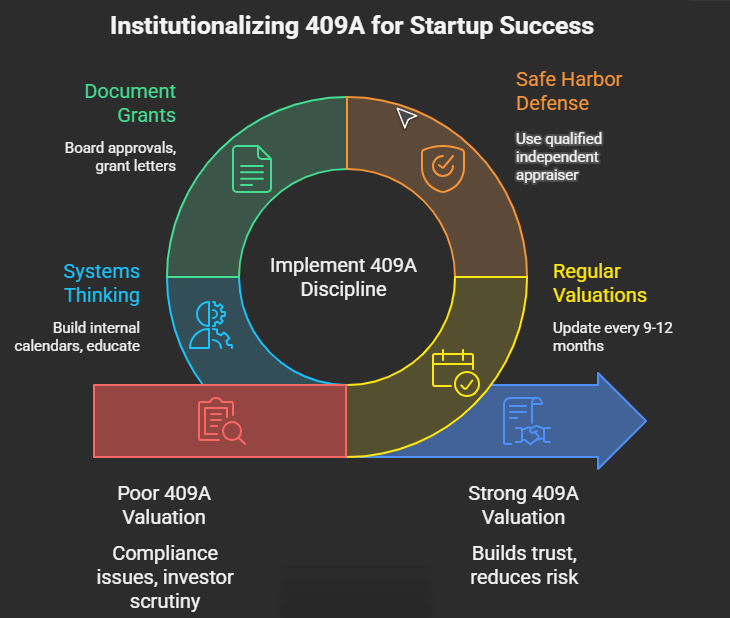

The best practice is to budget for a new 409A valuation every 9 to 12 months or sooner if there’s a capital raise or material change. A high-growth company may need two or even three valuations in a year. That cadence reflects seriousness and removes ambiguity for auditors and employees alike.

The Safe Harbor Defense—and Why It Matters

Section 409A includes a “safe harbor” provision that protects companies from IRS penalties if they use a qualified independent appraiser to perform the valuation. This is what most startups refer to when they say they are “409A compliant.” Once issued, the appraisal creates a presumption that the FMV is accurate, and the burden of proof shifts to the IRS if it wishes to challenge it.

But safe harbor is not automatic. It is only valid if the company follows specific rules. The valuation must be conducted by a qualified firm with sufficient experience, must be based on reasonable methodologies, and must consider all relevant information available at the time of the report. If a company overrules its appraiser’s recommendation, backdates grants, or ignores material events, the safe harbor evaporates.

I’ve seen founders try to “negotiate” valuations down to keep option prices low. In one case, a Series A company with fast ARR growth insisted on using a pre-funding valuation to issue grants. The appraiser flagged the risk, but management pushed forward. Months later, during diligence for an acquisition, the buyer’s tax team reviewed the discrepancy and demanded that option holders be grossed up for tax exposure—at the company’s expense. That one misstep costs both capital and credibility.

The lesson is simple: respect the process. 409A is not a negotiation. It is an audit defense mechanism.

Common Pitfalls—and How to Avoid Them

Several recurring mistakes surface in 409A compliance, especially among fast-growing startups. The first is misaligned grant timing. A board may approve grants weeks or months after hiring, backdating the effective date to the employee’s start. This is often done with good intentions, but if the FMV has changed in that time, the backdated grant is noncompliant.

Another pitfall is misunderstanding the relationship between preferred stock and common stock. Founders often assume that if their last preferred round was priced at $10 per share, the common must be close. However, methodologies such as the option pricing model (OPM) or the probability-weighted expected return method (PWERM) often yield much lower common values, particularly when liquidation preferences exist. Overpricing reduces the attractiveness of grants. Underpricing creates compliance exposure.

A third pitfall is failing to document grants. Even if the valuation is sound, without contemporaneous board approvals, grant letters, and clear option exercise terms, the structure becomes suspect. I’ve seen acquisition timelines delayed by months because diligence teams discovered missing documentation. At BeyondID, we leaned heavily on Carta’s integrated grant management to prevent these gaps. Every board approval, strike price, and grant letter was centrally recorded, making diligence straightforward.

Equity Strategy Depends on 409A Discipline.

At its core, the 409A valuation is not merely a matter of compliance. It is a pricing mechanism for the most critical element of startup compensation. If it is too low, you invite risk. If it is too high, you reduce motivational power. If it is outdated, you undermine your recruiting efforts.

Founders must consider 409A as part of their capital strategy. A clean, current valuation signals that the company is ready for diligence, prepared for hiring, and operating with governance maturity. It builds investor confidence, aligns incentives across teams, and protects employees from unintended tax consequences.

At Atari, the transition from boxed software to digital platforms showed me how quickly compensation models can become outdated when valuations don’t keep pace with business realities. At my logistics company in Berkeley, discipline around tax positions and valuation frameworks reassured private equity buyers during diligence. Across these experiences, the pattern has been consistent: companies that institutionalize 409A discipline reduce noise and build trust.

Building for Scalability—Through Systems Thinking

As startups scale, the stakes grow. What feels acceptable for a six-person team is reckless for a 150-person company preparing for an exit. 409A valuations are not static hurdles; they are dynamic checkpoints where finance, legal, and leadership intersect.

This is where systems thinking comes in. In systems theory, complexity can look like chaos until you find the governing rules. Finance works the same way. Every grant, every equity plan, and every valuation update is a data point in a larger system of trust. Left unmanaged, it devolves into confusion and risk. Managed with discipline, it produces clarity, alignment, and resilience.

Institutionalizing 409A requires building internal calendars, setting thresholds for what counts as a “material event,” choosing valuation partners who understand venture-backed dynamics, and educating both boards and employees on what valuations mean. Carta and similar equity management systems are not just tools—they are mechanisms for systematizing trust.

When done well, 409A is not just about avoiding penalties. It is about telling a coherent story to employees, investors, and acquirers: this company is built on discipline, not shortcuts.

Closing

409A valuations may not excite pitch decks or headline investor memos, but they are silent guardians of startup credibility. A founder’s promise that equity will create wealth is only as strong as the valuation underpinning it. By respecting 409A as a strategy, embedding it into systems, and using modern tools like Carta to institutionalize discipline, startups can turn what feels like a compliance burden into a narrative of maturity.

Done well, 409A builds alignment. Done poorly, it creates a hidden tax time bomb. In my career as CFO across multiple industries, this principle has held steady: financial systems may look like overhead, but they are engines of trust. And trust, more than any valuation multiple, is what keeps deals alive.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your specific situation.

Hindol Datta, CPA, CMA, CIA, brings 25+ years of progressive financial leadership across cybersecurity, SaaS, digital marketing, and manufacturing. Currently VP of Finance at BeyondID, he holds advanced certifications in accounting, data analytics (Georgia Tech), and operations management, with experience implementing revenue operations across global teams and managing over $150M in M&A transactions.