Introduction

Part One: Building Revenue Architecture That Actually Works

Where Numbers Tell Stories

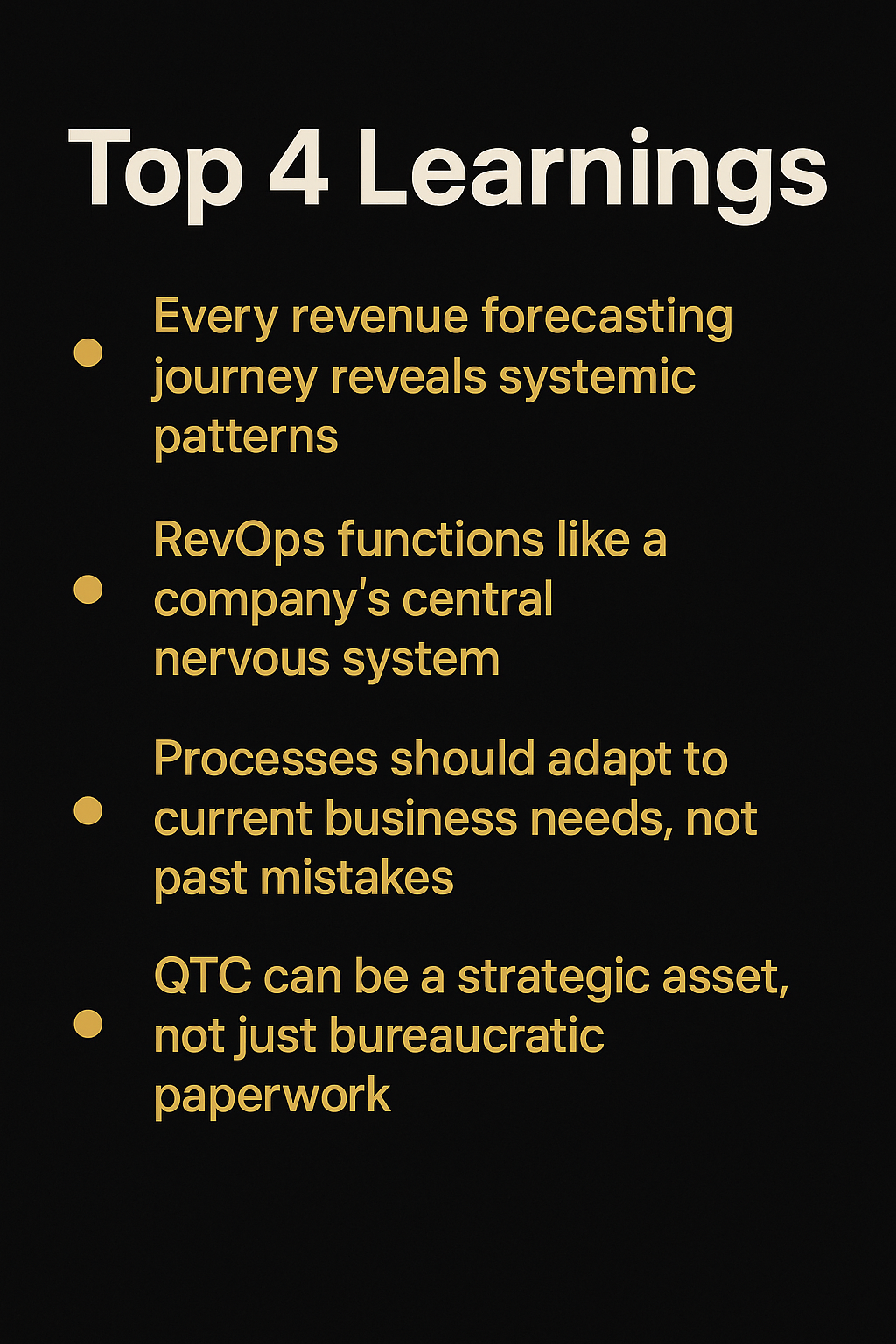

Every revenue forecasting journey starts somewhere unexpected. I was twenty-one, fresh out of California State University with my economics degree, absolutely convinced that numbers would speak clearly if I just organized them properly. They did talk, but not in the language I expected. That humbling moment taught me something I have carried through three decades in finance: systems are often more intelligent than their individual parts. What looked like an error was actually a broken flow. It reminded me why revenue forecasting is important, the real signal is not just in the totals but in the patterns that emerge. Understanding how to forecast revenue effectively means seeing beyond miscalculations, knowing that revops and revenue operations frameworks help surface those patterns. Learning what RevOps is, implementing strong RevOps strategies, and leveraging modern RevOps solutions turn data into actionable insight, ensuring that forecasting informs real business decisions.

This instinct for finding patterns behind numbers shaped everything that followed. During my tenure as CFO at companies like Singularity University and Lifestyle Solutions, I learned that reading financials alone is not enough. You have to interpret systems. I trace incentive structures through spreadsheets, detect organizational misalignment through margin drift, and diagnose friction by modeling flows rather than just asking managers.

My approach to global revenue optimization draws on a unique blend of perspectives: economics training at CSU, an MBA in accounting, and, later, data science studies at Georgia Tech. But more importantly, it comes from years of walking both factory floors and server rooms, learning how human decisions and digital systems collide.

Whether it is a pricing approval in Singapore or a failed renewal in Eagan, MN, the patterns always rhyme. And if you build your system to listen, it will tell you everything you need to know.

Revenue Operations as Your Company’s Nervous System

Few areas expose an organization’s true DNA like revenue operations strategy. This is where intent becomes contract, strategy becomes system, and promises become actual cash flow. When RevOps implementation works well, it functions like a central nervous system, interpreting customer signals, aligning internal actions, and adapting to feedback in real time.

When it fails? It calcifies into a maze of processes that reward conformity and punish the agility your business needs to thrive.

I have seen both scenarios across my roles at Atari (managing gaming studios in both California and France), Emerge Digital Group during their hypergrowth phase, and various other tech companies. In high-growth environments, revenue operations automation often becomes a victim of its own ambition. Teams add processes to reduce errors, then more processes to manage exceptions, until the original purpose disappears entirely.

The QTC (Quote-to-Cash) pipeline, designed to accelerate conversion, becomes a bottleneck. The deal desk, meant to align pricing and margins, becomes a source of negotiation fatigue. Finance gets caught in the middle, becoming either the enforcer or the scapegoat.

My approach starts with a simple assumption: no process is sacred. Every decision path, approval flow, and policy should serve a clear purpose rooted in system health. When it does not, we redesign. And redesigning does not start with meetings. It starts with mapping.

I have spent months tracing single QTC processes end-to-end across geographies, color-coding delays by root cause, tagging ownership ambiguities, and annotating margin erosion hotspots. The result is not just a prettier flowchart. It is a visual diagnosis of organizational friction. Once you know where the system fights itself, you can start to unblock it.

Process as Organizational Memory

Here is something I learned during my time managing supply chain and technology development at Lifestyle Solutions: process is memory. When a company creates an approval layer, It is memorializing a past mistake. When it builds an exception path, It is acknowledging system limits. But memory without context eventually becomes noise.

The sales operations management role, particularly for CFOs fluent in systems thinking, is differentiating what the process remembers from what the business actually requires today.

Take pricing approvals. At one enterprise where I consulted, the deal desk required manual review of every contract above $100K, regardless of product line or region. This was a relic from when the company had inconsistent SKUs and unclear margin floors. Those issues had been resolved through tiered pricing logic in their CPQ system, but the manual step remained because nobody had challenged the assumption.

We ran a risk-adjusted deal velocity model and discovered that removing the review step improved close rates by 12% without a single margin breach. We retired the step and created a system that could flag future anomalies rather than blocking every transaction.

This is not automation for efficiency’s sake. It is intelligence design. By embedding policy logic into systems as adaptive rules rather than static thresholds, we enabled speed without sacrificing control. Sales moved faster, finance retained visibility, and legal engaged only when deal profiles truly required it.

But this only works when the process becomes a feedback loop, not a one-way gate.

Where Sales Execution Meets Systems Intelligence

Sales process optimization done poorly becomes the friction layer between growth and compliance. Done well, it becomes the intelligence layer between signal and strategy. The difference is not in tooling but in orientation.

During my time at Adteractive, when we grew from $9M to $180M in just two years, I approached sales ops not as a policy enforcer but as a flow designer. The key question was not “Are we following process?” but “Is this process producing the right learning?”

We noticed deals entering Stage 4 of our funnel only to stall indefinitely. CRM logic marked them as “pending legal review,” but closer analysis revealed the real issue: 68% involved cross-border data transfer clauses that legal had no pre-approved language for. The system was not broken; it was uninformed.

We solved this through structured escalation rather than more oversight. We created decision-tree frameworks, built regional clause libraries, and allowed legal to predefine fallbacks. Sales reps did not have to wait. They had boundaries and, within them, autonomy. Revenue forecasting improved, legal escalations dropped, and sales closed more confidently.

This kind of system design requires fusing engineering logic with behavioral economics. It also requires empathy for sales, finance, and customers. But the payoff is significant: a system that evolves alongside its users.

QTC as Strategic Capability, Not Just Paperwork

I once asked a CEO during an offsite whether his company considered Quote-to-Cash a strategic differentiator. He looked puzzled. “Is not that just paperwork?” That question explained why the company was leaking 40 basis points in revenue margin.

Quote-to-Cash is not paperwork. It is your revenue spine. It defines how value translates from buyer intent into recognized revenue, encompassing pricing logic, contract design, billing triggers, tax treatment, and customer onboarding. Every misalignment delays cash, introduces risk, or erodes trust.

In my implementations, I have restructured QTC to generate insight, not just process orders. We log every pricing exception, billing dispute, and contract redline, categorizing by product, region, and sales owner. That data feeds quarterly reviews as opportunities for improvement, not complaints.

In one case, our QTC logs showed that Latin America consistently had higher late-stage deal-loss rates. The cause? Misalignment between VAT implications and invoice language. Finance worked with tax counsel to update localized billing templates. Legal embedded them into the CLM platform. Sales received updated collateral. Within a quarter, loss rates dropped and revenue grew. But more importantly, friction fell.

When architected with intelligence, QTC becomes a revenue intelligence platform.

Navigating Global Complexity

The moment an enterprise operates across borders, B2B revenue operations stops being procedural and becomes geopolitical. Transfer pricing becomes necessity, not nuance. VAT, GST, and digital tax compliance start shaping not just invoicing but go-to-market strategy.

I have navigated jurisdictions where misconfigured billing templates led to audits, and others where minor contract language variations caused months of cash repatriation delays. Drawing from my experience across companies like Atari’s international gaming studios, the CFO’s role in global RevOps is anticipating these frictions before they calcify.

In one global rollout, we modeled transfer pricing scenarios across four regions, aligning license revenue, implementation services, and renewal support into a unified intercompany agreement. We integrated these rules into our billing engine. Every invoice now aligns to tax-compliant flows. The cost was significant, but the benefit was exponential: compliance without compromise.

This is where revenue operations strategy evolves from an efficiency mechanism to a strategic platform. When built with foresight, it does not just scale; it also grows. It adapts.

Part Two: Global Intelligence and Strategic Signals

Revenue Does not Travel Well Without Context

In every global organization I have worked with, from gaming to edtech to hypergrowth startups, revenue does not travel well without context. A deal in Singapore flows differently from one in Germany. A quote approved in Toronto may stumble in São Paulo. Tax regimes, legal jurisdictions, FX volatility, and product localization complexity impose friction on what otherwise feels like a universal sales motion.

That is why global revenue optimization must embrace asymmetry, not resist it.

I learned this during my CFO tenure when implementing a RevOps system that worked flawlessly in North America but failed to launch in EMEA. The issue was subtle but revealing: VAT structures in certain EU countries required billing entities to reflect delivery obligations with far more granularity than our system supported. What seemed like a workflow issue was actually a tax compliance failure.

We re-engineered quote templates, reclassified SKUs, and adjusted recognition logic. More importantly, we embedded tax review as rule-based checks within the CPQ engine, not downstream corrections. This became a core principle: do not delegate tax intelligence to audits. Build it into the deal lifecycle.

Transfer Pricing as Revenue Architecture

Transfer pricing rarely gets discussed in revenue operations circles. It should. In multi-entity SaaS or services businesses, how internal revenue flows across jurisdictions shapes everything from margin to cash repatriation to compliance posture.

Drawing from my experience managing international operations, I have worked with structures that allocate IP income to Ireland, service delivery to India, and renewal revenue to the U.S. Each choice has legal and economic consequences that must be reflected in how sales, finance, and operations execute deals.

One effective model I deployed was a matrix that aligned product family, region, and revenue type (license, support, services) with entity-specific pricing rules. These rules fed into our deal desk and CPQ platforms. We linked them to FX hedging thresholds and updated intercompany service agreements annually.

This architecture empowered sales leadership as well. By tying discount approvals to net-margin retention after transfer pricing, we ensured that incentives did not encourage growth at the expense of compliance. When sales, legal, and tax operate harmoniously, regional strategies gain traction without sacrificing margin or compliance.

Deal Desk as Intelligence Hub

Most companies position deal desks as control mechanisms. I position them as insight mechanisms. When designed as real-time policy interpreters, deal desks become the most dynamic compliance safeguards in organizations.

I have built systems that trigger tax alerts, regional legal clause substitutions, and FX adjustments based on deal metadata, not manual review. In one global implementation, we tied clause libraries directly to deal attributes: jurisdiction, product type, and contract value.

A deal valued at over $500K in Japan triggered data localization provisions. A renewal in Germany over specific sizes required dual-invoice tracking for VAT auditability. Sales did not need to know these rules. The system surfaced them as part of the deal flow. Legal and finance monitored exceptions, not every transaction.

That shift from gatekeeping to rule-based flow changed how organizations viewed deal desks. Instead of slowing revenue, they guided revenue through the global constraint terrain. I compare this to air traffic control: the best systems do not just prevent crashes; they optimize route efficiency.

Regional Pricing Strategy: The Art of Adaptive Revenue

The moment companies expand globally, uniform pricing becomes a myth. I have structured pricing for multinational offerings across six continents and never found a one-size-fits-all model that held. Reasons include economic elasticity, procurement behavior, tax rates, competitive parity, and invoice processing capabilities.

In Southeast Asia, we observed low win rates despite strong demand. The issue was not product fit but pricing rigidity. Local procurement teams required total cost predictability across multi-year contracts. Our North American discount model, built around upfront commitments, was incompatible.

We introduced region-specific deferred pricing bands, embedded them in CPQ rulesets, and immediately saw jumps in close rates and expansion bookings. That experience reinforced my belief: regional pricing is not a revenue leakage risk but a revenue unlocking mechanism. But it must be structured, not improvised.

We manage this through playbooks aligning CRO goals, CFO guardrails, and marketing’s brand equity. Discounts are not negotiated; they are designed.

NPS in Cross-Border Context

Customer lifetime value calculations often rely heavily on Net Promoter Score, but I have learned through statistical modeling that NPS behaves very differently across cultures. A 7 in Japan is not the same as a 7 in Brazil. Regional expectations, service baselines, and communication norms color how customers rate performance.

To interpret NPS correctly, we segment by geography, cohort maturity, and customer type. More importantly, we correlate scores with behavior, not sentiment alone. In one analysis, detractors in Europe had lower churn than passives in the U.S. Why? European buyers used NPS as feedback. U.S. buyers often said nothing until they left.

We built normalized models using NPS trends, product usage telemetry, and support case frequency. This produced predictive churn scores with regional nuance, serving as the foundation for Customer Success prioritization and sales renewal risk assessments.

By linking NPS patterns to LTV calculations and churn rates, we quantified sentiment’s impact on revenue. We could answer questions like, “How many points of NPS improvement are worth one point of retention?” That is not just a strategy. That is economic clarity.

Building Systems That Learn

Drawing from my data science training at Georgia Tech, the most enduring systems I have built share one trait: they evolve. Revenue reporting automation should not just record outcomes; it should learn from them.

When approval engines log overrides, we review them monthly for pattern shifts. When contract lifecycle systems hit recurring negotiation delays, we flag them to legal for preemptive redesign. When tax rules change, we update entity rules and test deal flow within 24 hours.

I have led teams where feedback loops are hardcoded into systems. Our revenue operations platform did not just quote; it reported friction. Our CRM did not just track contacts; it tracked deal health by taxonomy. Our deal desk software did not just monitor margin; it learned margin behavior.

These loops are not expensive to build, but they require valuing system feedback as much as top-line bookings. This is where CFOs must lead not from control but from architectural stewardship.

Conclusion: The CFO as Global Systems Architect

Revenue has grown more complex than any single function can manage alone. Tax, finance, sales, legal, and customer success now intersect in every meaningful transaction. Revenue operations management, once an afterthought, is now the nerve center of modern enterprises. Within it, CFOs play evolving roles as systems thinkers, strategists, and stewards of global complexity.

Over three decades, from my early days with that unbalanced ledger through CFO roles at Atari, Emerge Digital Group, Singularity University, and beyond, I have watched financial leadership shift. We no longer report numbers. We design conditions that produce better numbers. We align systems, not just close books. We build feedback loops, not just budgets. We anticipate friction, not just forecast growth.

As organizations expand, pricing localizes, and compliance deepens, CFOs have opportunities and responsibilities to build a revenue operations strategy that not only scales but also adapts. When we succeed, we do not just enable revenue. We unlock resilience.

That is the true test of financial leadership in our global, digital age: building cross-functional revenue alignment that learns, adapts, and thrives across the beautiful complexity of international business.

Hindol Datta brings over 30 years of finance and operations experience across hypergrowth startups and established enterprises. His background spans economics (CSUEB), accounting (MBA), and data science (Georgia Tech), with CFO and CRO experience at companies including Atari, Emerge Digital Group, Singularity University, and Lifestyle Solutions.