The Framework

Startups are built to move quickly, not perfectly. In the rush to acquire customers, ship code, raise capital, and manage burn, many founders overlook how to improve business efficiency through structured financial planning and disciplined execution. Among the most overlooked business strategies for startups is a well-defined efficiency strategy, one that aligns growth ambitions with sustainable financial operations. In its absence, founders often ignore a quieter threat to their financial health: the slow leak of unclaimed credits, unnecessary tax payments, and suboptimal entity structures. Unlike fundraising delays or missed product milestones, these losses rarely make headlines. But they matter. Over time, they drain capital, extend burn, and, most critically, reveal gaps in a company’s business startup strategy and operational discipline.

As an operational CFO who has advised companies across cybersecurity, SaaS, logistics, gaming, and digital marketing, I’ve seen how often these missteps are framed as tactical oversights. In truth, they are strategic gaps. They reflect a lack of systems engineering, which means there are no structures that surface tax opportunities, mitigate liabilities, and align processes with the growth strategy. For early-stage companies, especially, these inefficiencies are avoidable. But only if they are made visible.

This essay explores the most common ways startups leave money on the table through missed credits, ignored deductions, inefficient structures, and weak systems. It also outlines how founders can shift from reactive compliance to proactive optimization, and how tax awareness becomes a hidden growth lever when embedded early.

The Hidden Wealth in Tax Credits

Federal and state tax credits exist to reward business behavior. For startups, the most powerful of these is the Research and Development (R&D) credit. It allows eligible companies to offset up to $250,000 of payroll tax liability each year for qualified research activities. Yet year after year, founders fail to claim it.

The reasons vary. Some assume they don’t qualify because they have not commercialized a product. Others lack the documentation to support the claim. Still others rely on outsourced tax providers who aren’t incentivized to dig deeply into engineering workflows. The result: tens of thousands, and often hundreds of thousands, in forgone credits.

At a Digital Technology Company, where I led finance and analytics, we reframed our engineering workflows through a tax lens. By working closely with engineers to document technical sprints, we qualified for R&D credits that directly extended our cash runway. At a logistics company in Berkeley, the discipline was similar: mapping IT development costs for warehouse automation into a credit framework saved six figures annually. These credits were always available. The challenge was financial discipline and visibility.

The same principle applies to other programs—such as the Work Opportunity Tax Credit (WOTC), which incentivizes hiring disadvantaged groups, or state-specific job-creation incentives. These programs are not obscure, but they require integration between HR, finance, and operations. They also need a CFO strategy that treats taxes as an asset class rather than a cost center.

Poor Bookkeeping Undermines Deductions

The inverse of a missed credit is a lost deduction. This happens when expenses are misclassified, under-documented, or omitted. Startups often defer robust bookkeeping in favor of speed. But tax optimization demands granularity. Every expense must be traceable.

Common losses arise in travel, contractor services, and software tools. These often get lumped into “Operations” without detail. That lack of detail creates inconsistencies between financial reporting and tax returns, risking lost deductions and undermining investor confidence.

At Lifestyle Solutions, where I served as CFO, a disciplined approach to expense classification enabled us to uncover hidden deductions while increasing transparency for investors. At GN ReSound, a global medical device company, we had to map R&D costs across jurisdictions to ensure alignment between tax filings and regulatory reporting. That discipline made audits smoother and ensured we could claim credits without delay.

Clean books are not just an administrative function. They are a signal of capital efficiency and readiness for financial due diligence.

The Wrong Entity Costs You Twice

The entity structure chosen at formation often lingers untouched, even as the company evolves. A C-Corp might have been necessary for VC funding. An LLC might have been used for speed or flexibility. But over time, the tax implications can become misaligned with business strategy.

C-Corps face double taxation unless mitigated by QSBS treatment or compensation planning. LLCs create pass-through income, which complicates cash flow and tax obligations. I’ve seen founders stay in LLCs too long, losing QSBS eligibility and investor interest. Others switched too hastily, triggering unintended liabilities.

When I was at Accenture, we modeled multiple entity structures for clients expanding into international markets. The decision was never about “paperwork.” It was always about financial strategy, capital allocation, and risk. The same mindset applies to startups. The entity structure is not compliant. It is systems engineering applied to legal design: choosing the structure that minimizes entropy, maximizes runway, and scales with growth.

Underutilized Losses and Overstated Assets

Startups often operate at a loss in their early years, creating net operating losses (NOLs) to offset future profits. But these only matter if preserved correctly. Section 382 limitations—triggered by ownership changes—can sharply restrict their use.

In one diligence process I supported, a buyer assumed the seller’s $4 million in NOLs would provide a tax shield. But earlier funding rounds triggered ownership changes, reducing the usable amount to $500,000. The founders unintentionally overstated an asset, creating friction and lowering deal value.

This is where systems thinking matters. Every financing event should trigger a recalculation of NOL usability. At BeyondID, we built a process to update deferred tax models quarterly. That process was less about compliance and more about investor confidence.

Stock-Based Compensation: Where Good Intentions Invite Bad Outcomes

Equity is the most common currency for startups. But it is also one of the most misunderstood. Options, RSUs, and equity-linked instruments affect both the company’s tax position and employees’ liability.

Grants without 409A valuations may violate IRS rules. Missed 83(b) elections can convert capital gains into ordinary income. At Atari, I saw how the shift from shrink-wrapped products to a digital MMO environment reshaped compensation and incentives. It was not just about dilution, but it was about designing tax-efficient equity that scaled with business models.

Startups need cadence. Quarterly valuations during rapid growth. Documented board approvals. Early employee education. Equity should motivate—not surprise. Done right, it builds investor confidence and accelerates M&A readiness.

Systems Engineering: Finding Order in Financial Chaos

The most efficient startups think like systems engineers. They understand that tax optimization is not about chasing loopholes. It is about designing processes that minimize entropy. Systems theory teaches us that order emerges when small, repeatable rules create stability. Finance operates the same way.

At United Way, where I advised on financial systems, we built structures to integrate donor reporting, compliance, and governance. These were not one-off fixes, but they were systems that scaled trust. In startups, embedding checkpoints for tax compliance in hiring, contracts, and product launches reduces downstream risk.

Systems engineering is not abstract. It is an applied strategy. It is the reason clean books support financial due diligence, why strong controls protect growth capital, and why repeatable processes improve valuations.

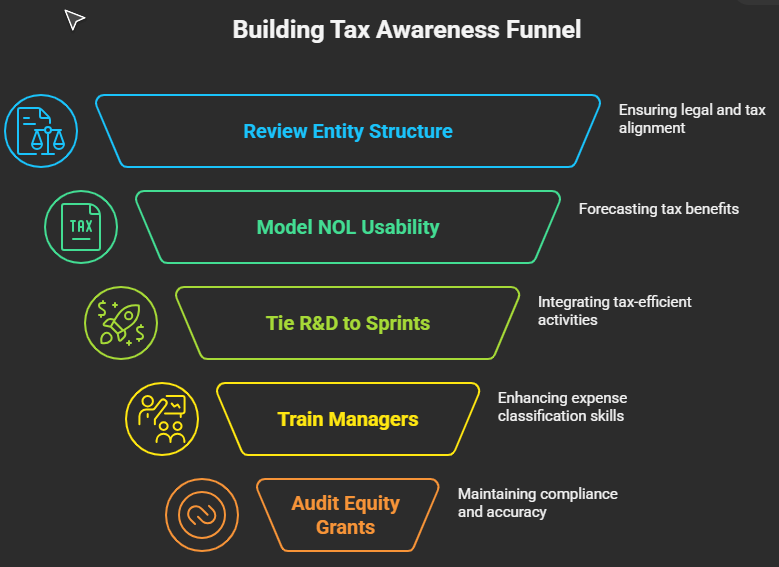

How to Build a Culture of Tax Awareness

Most founders don’t lose money to taxes because they are careless. They lose money because their systems don’t notice. Building tax awareness is not about memorizing regulations. It is about creating checkpoints:

- Review entity structure at each funding round.

- Model NOL usability quarterly.

- Tie R&D activities to engineering sprints.

- Train managers on expense classification.

- Audit equity grants regularly.

The companies that succeed treat tax as a strategic lever. They see it as capital efficiency. They know that every tax dollar saved is a dollar of growth capital preserved.

At a cybersecurity company, this philosophy shaped how we approached finance. The logistics company guided us on how to build BI models to track efficiency. At Ronin & Co LLC ( Accounting Firm) , we were informed how we advised clients on global expansions. In each case, tax optimization was not overhead. It was a strategy.

Conclusion

Startups don’t need to become tax experts. But they must build systems that ensure tax is never an afterthought. The real cost of inefficiency is not just money left on the table—it is trust lost with investors, leverage lost in negotiations, and capital lost in growth.

A founder who sees tax as a system to be optimized, not a compliance box to be checked, creates resilience. They build credibility. And they stop leaving money on the table.

Disclaimer

This blog is intended for informational purposes only and does not constitute legal, tax, or accounting advice. You should consult your own tax advisor or counsel for advice tailored to your situation.

Hindol Datta, CPA, CMA, CIA, brings 25+ years of progressive financial leadership across cybersecurity, SaaS, digital marketing, and manufacturing. Currently VP of Finance at BeyondID, he holds advanced certifications in accounting, data analytics (Georgia Tech), and operations management, with experience implementing revenue operations across global teams and managing over $150M in M&A transactions.