Introduction

Part One: Building the Revenue Bridge Between Product and Sales

The Hidden Revenue Leak Nobody Talks About

After twenty-five years managing revenue operations strategy across cybersecurity, SaaS, digital marketing, and manufacturing companies, I have discovered something most CFOs miss: the biggest revenue leaks do not show up in your QTC reports or churn analytics. They hide in the gap between what Product builds and what Sales actually sells. This is why sales alignment matters so profoundly, and why leaders must align sales and marketing more intentionally. In my experience, aligning sales and marketing strategies, increasingly supported by AI, highlights the difference between incremental growth and scalable, durable revenue.

During my tenure at companies like Atari (managing global gaming operations), Emerge Digital Group (scaling from $9M to $180M), and currently at BeyondID, I have sat through countless meetings where Sales begged for flexibility while Product demanded precision. The solution never lay in compromise. It required alignment around a shared model of how product changes influence pipeline management, deal velocity, and customer retention.

This alignment demanded structure and systems, not just better communication. It required a CFO’s perspective on flow, not just departmental functions.

Seeing Product Launches as Financial Systems

In my early career at companies like GN Resound and Coopers & Lybrand, I treated product launches as isolated events. Marketing celebrated them, Sales exploited them, and Finance forecasted them. I tracked SKU-level orders and aggregated them to revenue. I missed the bigger opportunity.

Each new feature or packaging change carries upstream signals revealing how buyers perceive value, how quickly deals close, and how retention curves shift. To surface those signals, I needed to embed revenue operations automation into every stage, from product roadmap discussions to renewal negotiations.

The turning point came during my time at Lifestyle Solutions, where we introduced a major analytics feature. Sales leaders wanted empowerment tools. Product managers celebrated innovation. But without predefined messaging, selling frameworks, or success metrics, we risked rolling out a solution that became just another checkbox in deals.

Instead, we treated it as a product-sales experiment. We tagged every opportunity, including that feature. We traced win rates, time-to-close, average revenue per customer uplift, and churn impact. We monitored whether the feature inflated deal sizes or delayed closings. We fed those findings back into product scaling decisions, not just quarterly reviews.

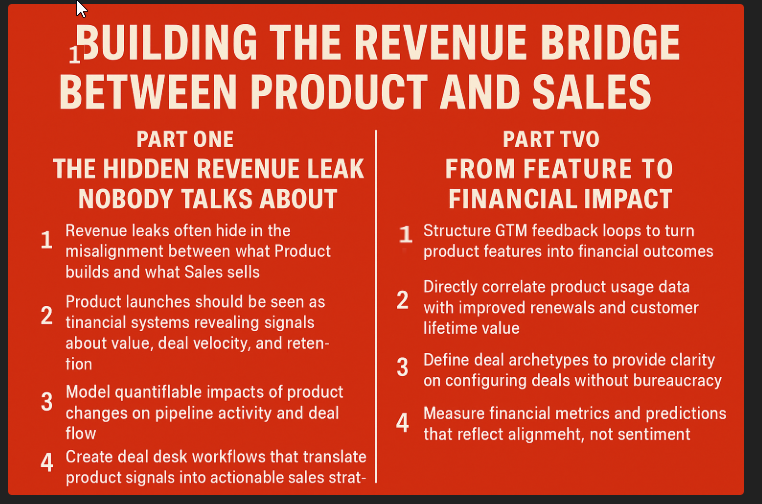

Suddenly, we were not just selling software. We were selling validated value backed by financial rigor. Here is a quick summary in the infographic.

Product Changes as Revenue Levers

Modern CFOs need models for product influence beyond fuzzy sentiment or anecdotal usage. We need complex data on how product velocity affects deal-flow optimization. Drawing on my data science training at Georgia Tech, we built a “feature halo” model that cataloged which new features influenced pipeline activity, accelerated negotiations, or drove higher acceptance rates.

Each feature became a signal in our revenue forecasting model. In one case at BeyondID, a content-marketing wrapper we thought would boost lead generation had little impact on the pipeline. Instead, a minor integration feature accelerated late-stage closures by ten days, delivering much faster ROI. We reallocated a six-figure marketing budget accordingly.

That decision did not come from analytics alone. It came from linking product utilization to deal velocity, pricing power, and churn likelihood using the systematic approach I had developed across multiple CFO roles.

Deal Desk as an Intelligence Translation Layer

No system integration survives without translation mechanisms. Our RevOps implementation team built deal desk workflows that applied product signals to real deals. When reps submitted deals with tagged features, our deal desk automation surfaced not only pricing and approval logic but also the features ‘proven impact on deal health and renewal value.

For deals lacking essential features but pitched as comprehensive solutions, the deal desk flagged upsell potential rather than discount opportunities. We also integrated Product managers into deal desk roundtables twice monthly. They heard frontline objections, deal blockers, and customer nuance directly. They saw where roadmaps outpaced messaging, or why sandbox features failed in field demos.

This bidirectional loop transformed roadmap planning. It accelerated clarity, reduced friction, and maintained velocity while improving cross-functional revenue alignment.

Velocity Without Complexity

Alignment initiatives often slow execution, trapping teams in review cycles and roadmap freezes. Our challenge was different: gaining alignment without losing momentum. We solved this by defining three-tiered milestones for every feature: Launch, Learn, and Lockdown.

Launch required internal readiness, GTM messaging, and deal desk tagging. Learn demanded closed-loop win-loss feedback, usage correlation, and impact modeling. Lockdown required a decision: fully embed in pipeline logic or sunset the feature. Each feature moved through this path in weeks, not quarters.

We ran weekly syncs, tied features to revenue performance metrics, and escalated only when metrics stagnated. This kept velocity fluid while building systematic coordination across teams.

Part Two: From Feature to Financial Impact

GTM Architecture That Actually Works

In many companies, features live simultaneously in product specs and sales decks but never speak the same language. Sales wants simplicity. Product wants specificity. Marketing wants storytelling. Drawing on my experience managing global teams across the US, India, and Nepal, I saw my CFO role not as an arbiter but as a translator.

I structured feedback loops that turned feature sets into financial outcomes and narratives into operational experiments. We scored every product launch not by press releases or NPS spikes, but by its impact on pipeline velocity and sales-stage acceleration.

We tracked which features got mentioned in early-stage demos, which influenced pricing uplift, and which delayed deals due to integration concerns. That insight gave Marketing clarity. They stopped chasing attention and started amplifying what actually drove revenue. Product teams followed suit. Features tied to margin expansion gained roadmap priority. Those lingering in MVP limbo quickly fell out of scope.

Revenue Attribution That Changes Everything

The first time we tracked product usage data directly into renewal forecasting models, we discovered something profound. Customers engaging consistently with just three specific features renewed at 18% higher rates and expanded 25% more frequently. Yet those features had not featured prominently in upsell calls or implementation guides.

We acted immediately. Revenue operations management adjusted onboarding journeys to prioritize early exposure to those features. Customer Success began using usage metrics in QBRs. Sales started referencing usage correlation in expansion pitches.

The result was not just better renewals. We improved the customer lifetime value-to-customer acquisition cost ratio and reduced onboarding costs. These classic CFO metrics were delivered through Product-Sales alignment, leveraging my experience across 14+ audit cycles and multiple M&A transactions totaling over $150M.

Deal Archetypes: Clarity Without Bureaucracy

Many CFOs fear that deeper Product-Sales alignment will slow deals or add bureaucratic overhead. Drawing from my experience implementing sales process optimization across multiple companies, I found the opposite. Alignment reduces uncertainty, and when teams know what works, they execute more efficiently.

We built “deal archetypes” based on win-loss analysis from my controllership experience. These standard configurations tied product mix, ACV ranges, usage risk, and ramp timelines together. Each archetype included playbooks with recommended pricing bands, approval logic, onboarding assumptions, and financial guardrails.

Sales did not need permission; they needed clarity. Product did not need sign-offs; they needed feedback loops. Our Quote-to-Cash optimization infrastructure included embedded logic flagging deal terms misaligned with product usage assumptions. This did not block deals; it informed reps while Finance and Sales shared the same dashboard.

Incentive Alignment Without Innovation Sacrifice

One of the most nuanced tensions in Product-Sales alignment is incentive structure. Sales teams optimize for the current quarter. Product builds for future quarters. Left unmanaged, this divergence stalls collaboration. Structured wisely, it becomes a powerful creative source.

I introduced dual metrics into quarterly business reviews. Sales leaders reported on feature-linked velocity and margin performance. Product leaders reported on revenue acceleration and the impact on renewals. This symmetry-aligned focus is without pitting long-term roadmaps against short-term pipeline goals.

We also launched quarterly “Revenue Insight Sprints” in which RevOps, Product, and Finance each shared insights on how product behavior influenced financial or customer behavior. One session revealed that customers adopting workflow automation within 30 days renewed at 30% higher rates. Another found a “core” feature had zero impact on pricing negotiations.

These insights emerged from multi-disciplinary analysis, structured dialogue, and shared incentives rather than dashboards alone.

Financial Metrics That Matter

As CFO, I measure alignment through signal, not sentiment. If alignment improves retention predictability, reduces onboarding friction, and shortens days sales outstanding, it works. If not, It is noise.

One powerful metric we developed was “time-to-margin” curves, measuring not when revenue hit P&Ls, but when it yielded positive gross margins. For SaaS businesses, service-heavy deals might take months to show profitability. When Product designed more straightforward setup flows or Customer Success introduced earlier feature guidance, we noticed that the curves steepened. We saw positive margins in month one, not month four.

Churn prediction also became more accurate. Instead of treating churn reactively, we modeled it as a function of feature adoption lag, onboarding time, and usage volatility. Product managers began viewing churn as design opportunities rather than just Customer Success problems.

This shift from defending metrics to designing better economics was only possible when Finance structured conversations properly.

Part Three: Building Systems That Scale

The Anatomy of Product-Sales Misalignment

Misalignment typically manifests in five ways: promise drift, prioritization gridlock, broken feedback loops, compensation asymmetry, and time-horizon conflicts.

Promise drift occurs when Sales extends the scope to close deals while Product commits to roadmaps they cannot deliver on time. Prioritization gridlock happens when Product sets roadmaps based on strategic initiatives while Sales pushes for quarterly needs. Feedback loops break when Sales captures customer insights without roadmap delivery channels.

Compensation asymmetry creates toxic dynamics when Sales earn on ACV regardless of product configuration, while Product measures on usage or NPS. Time-horizon conflicts are structural: Product thinks in quarters or years while Sales operates in weeks or days.

Drawing from my experience across companies like Singularity University and Atari, these patterns require systematic solutions, not one-off interventions.

Revenue Attribution Mapping

The first step is making misalignment visible through data. Which features sell? Which get used? What is the margin profile of each configuration? What is the renewal rate by feature adoption?

I implemented “Revenue Attribution Maps” breaking down revenue by product bundle, activation rate, and renewal impact. We showed not just what sold, but what created lasting value. This changed conversations. Sales reps saw which bundles led to better upsells. Product managers saw which roadmap items drove margins.

Systematic Feedback Without Bureaucracy

CFOs must institutionalize feedback without slowing momentum. One mechanism I used was 6-Week Sprint Debriefs. After major product releases, small teams from Product, Sales, RevOps, and Finance met for 1 hour to analyze uptake, sales friction, quote behavior, and support load.

Over time, this built organizational muscle memory. Sales began requesting data-informed training materials. Product asked Finance for margin impact scenarios. The loop became self-sustaining without executive escalation.

Measuring Alignment as a Strategic Asset

Most companies measure Sales productivity and Product velocity separately. Few measure alignment itself. We tracked four key metrics:

- Time from product launch to revenue impact

- Percentage of deals using recommended product bundles

- Feature-linked renewal rate uplift

Average DSO for new products versus legacy offerings. These metrics revealed whether teams rowed in the same direction. When the alignment dipped, we ran diagnostics, not workshops. Finance owned the scorecard while Product and Sales owned the improvement levers.

Conclusion: The CFO as Revenue Systems Architect

After implementing revenue operations strategy across cybersecurity, gaming, digital marketing, and manufacturing, I have learned that Product-Sales alignment is not achieved through meetings or declarations. It requires mechanisms, instrumentation, and Finance ownership of flow quality between promise and delivery.

Velocity and alignment are not opposing forces. When structured thoughtfully, alignment accelerates performance. It eliminates rework, focuses messaging, reduces customer confusion, and allows sellers to sell what lands while builders build what sticks.

Modern CFOs must serve as signal integrators sitting at the intersection of roadmap intention, market feedback, and revenue realization. Done well, we transform alignment from corporate jargon into operating advantage visible in every deal closed, dollar retained, and feature shipped with purpose.

Drawing from my 25+ years across public and private companies, extensive audit experience, and M&A transactions, I have watched Product and Sales teams co-design GTM motions, co-own backlog priorities, and co-deliver customer outcomes. That partnership rarely happens organically. It must be engineered.

The most overlooked architect of that partnership? The CFO who builds data models, feedback systems, and incentive structures that make sustainable B2B revenue operations alignment possible.

Hindol Datta, CPA, CMA, CIA, brings 25+ years of progressive financial leadership across cybersecurity, SaaS, digital marketing, and manufacturing. Currently VP of Finance at BeyondID, he holds advanced certifications in accounting, data analytics (Georgia Tech), and operations management, with experience implementing revenue operations across global teams and managing over $150M in M&A transactions.