Introduction

Part I: Understanding MEDDPICC in a Revenue Operations Lens

From Personal Revelation to Methodological Clarity

In my first decade as a finance executive immersed in systems thinking and decision theory, I encountered countless sales pipelines riddled with leaks and blind spots. When I first discovered the MEDDPICC sales methodology, I remember feeling that this framework spoke the language of precision I had sought for years. The MEDDPICC methodology mirrored the algorithms I used in search theory: structuring information, reducing noise, and generating signals. It reminded me of a well-designed control system, each stage amplifying forecast accuracy and tempering sales enthusiasm. I internalized the framework not as a tool for compliance but as an instrument to orchestrate revenue quality, much like the rigor embedded in MEDPICC itself.

Tracing Origins with Authentic Context

I learned through research that MEDDPICC traces its roots to early 1990s enterprise sales at PTC. Dick Dunkel, alongside John McMahon, systematized what top reps had intuitively practiced. MEDDIC emerged with six elements, and later practitioners added Competition and Paper Process to form MEDDPICC. Force Management and MEDDIC Academy later institutionalized training, and by the 2000s, the framework had become a cornerstone of enterprise GTM strategy. I found that its structured approach aligns directly with RevOps principles: unify systems, reduce ambiguity, optimize handoffs.

Adopting MEDDPICC in RevOps and Sales Processes

I adopted MEDDPICC in environments from Silicon Valley startups to global enterprises. I saw how sales teams cloaked opportunities in optimism, ignoring red flags embedded in process gaps. I then worked with RevOps and Sales Ops to embed MEDDPICC into CRM workflows, dashboards, and playbook triggers. They called on Metrics and Economic Buyer signals during discovery, Decision Criteria and Process flags during qualification, Paper Process reminders as legal prepared contracts, and Champion, Pain, and Competition insights during negotiations. Suddenly, every opportunity had a roadmap. Forecasts improved, churn costs dropped, and sales velocity climbed.

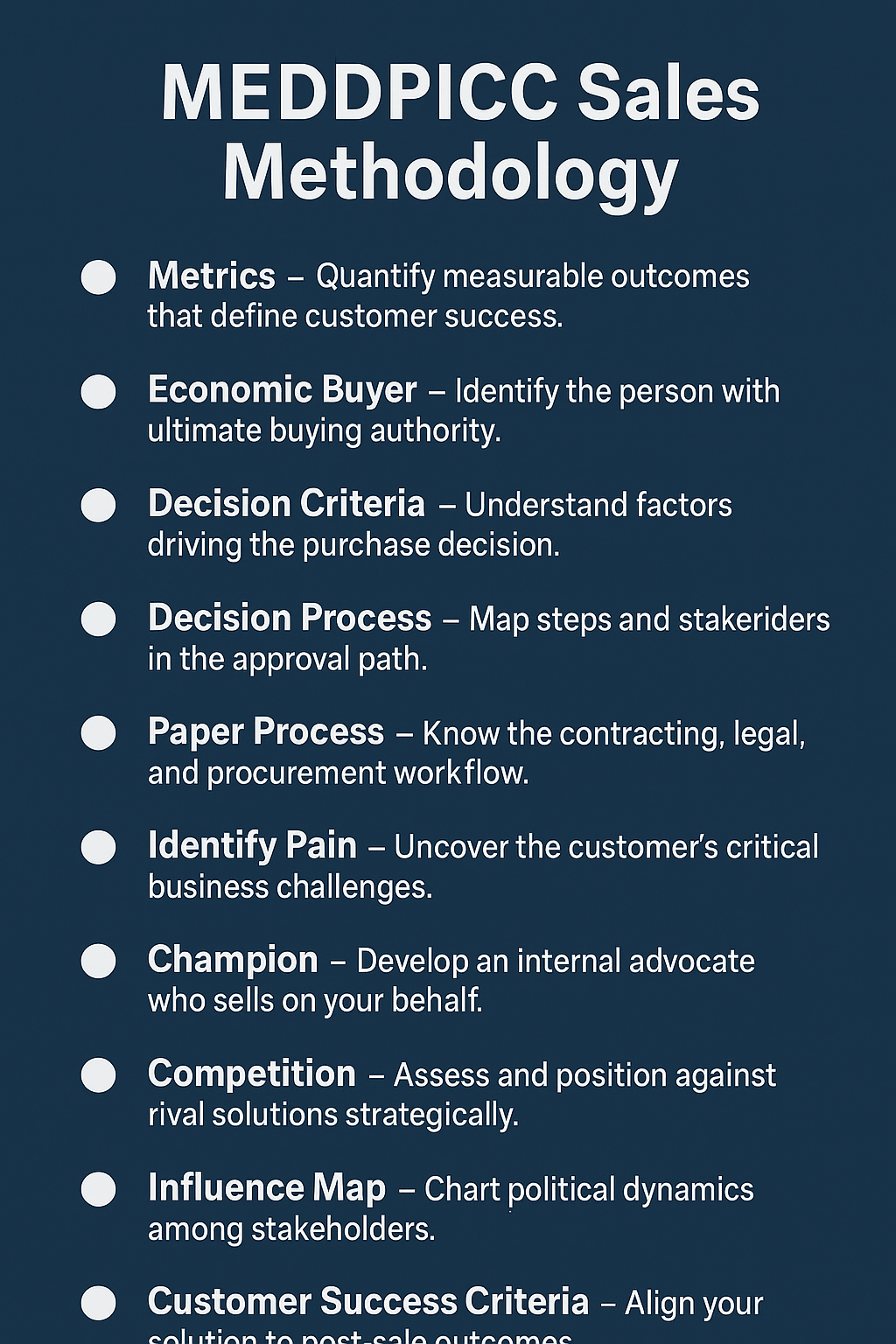

A Structured Table to Clarify the Mechanism

Below is a table mapping each MEDDPICC element to its functional role in RevOps and Sales Ops. It shows how teams direct buyer momentum while protecting operational integrity.

| MEDDPICC Element | Definition | RevOps Role | Sales Ops Role |

| Metrics | Quantifiable business benefits | Feeds forecast models; calibrates KPI thresholds | Guides sellers to tie deals to value |

| Economic Buyer | Authority to approve budget | Verifies budgeting and payment authority | Coaches reps to secure sponsor access |

| Decision Criteria | Selection benchmarks | Maps to pricing, compliance, feature requirements | Informs playbook alignment |

| Decision Process | Steps and timeline of buyer | Tracks time-to-close and deal stage consistency | Structures sales cadence |

| Paper Process | Contract approval steps | Flags legal/tax hold points | Prepares reps for typical redlines |

| Identified Pain | Emotional or operational need | Supports churn prediction models | Helps reps pivot messaging |

| Champion | Internal advocate | Validates account risk/reward projections | Enables account-level engagement |

| Competition | External alternatives | Enables win-loss analysis | Guides differentiator strategies |

This table reflects lessons I honed after designing dashboards and reviewing CRM data across geographies. Each element became a structured input into forecasting models, aligning finance and sales through shared metrics.

Transitioning from Theory to Practice

When I introduced this model at a global software firm, I aligned dashboards and RevOps workflows. I led revenue forecast meetings focused on MEDDPICC completeness rather than gut feelings. We set thresholds: for example, deals without an identified Economic Buyer remained in “review” until fixed. CRM reports surfaced weak signals, such as missing Paper Process flags, and triggered coaching. We used these insights to improve conversion rates, reduce cycle time, and forecast with greater confidence.

The CFO’s Imperative: Foreseeing and Minimizing Churn

From the CFO’s desk, I also see how effectively MEDDPICC directly influences forecast accuracy and customer retention. Deals that cross all eight checkpoints deliver cleaner revenue streams. When customers articulate Metrics and have Champions, they engage more deeply post-sale. Recognizing Economic Buyers and following Decision and Paper Processes reduces late-stage drop-off and contract friction. As a result, I saw churn costs drop materially. I retired as CFO of a firm that reported net-dollar retention above 120%, attributing that outturn in part to disciplined qualification via MEDDPICC.

CRO Perspective: Guiding Sellers, Not Handcuffing Them

Chief Revenue Officers often challenge deal qualification frameworks. They fear frameworks slow down reps. I addressed those concerns directly. I invited sales leaders into the RevOps design process. Salespeople helped define what qualified signals matter. We built playbooks around MEDDPICC stages rather than gating them. For example, rather than holding back deals without Economic Buyer identification, we offered intercept outreach suggestions. Instead of punishing reps for missing competition discussions, we supplied competitor comparison kits.

Sales Ops teams helped reps map MEDDPICC elements to their existing tools for example, pop-up reminders in CRM, automatic deal scoring, playbook snippets in call decks. Sales velocity metrics improved because reps closed high-quality deals faster. CROs began to describe MEDDPICC not as bureaucracy, but as a seller-first system that surfaces friction and injects opportunity.

Marketing and GTM Messaging under the MEDDPICC Lens

I also saw the impact on GTM alignment. Head of Sales & Marketing roles grew more intentional. When marketers embedded MEDDPICC into buyer journeys by asking target accounts to consider Metrics and Pain in their content, they allowed sales to lean in more effectively. DemandGen campaigns began to measure Economic Buyer engagement. Case studies emphasized decision criteria and champion voices. Marketing messages became sharper, more aligned to what buyers care about—the result: smoother handoffs, warmer leads, better-qualified pipeline.

Part II: Embedding MEDDPICC into Systems, Culture, and Intelligence

Systems Thinking in Action

My fascination with systems thinking dates to academic explorations on LinkedStarsBlog and InsightfulCFO.blog, where I wrote about search theory and decision-making under uncertainty. In implementing MEDDPICC I saw it manifest as a system of interlocking feedback loops. RevOps continuously monitors each deal’s MEDDPICC completeness. Sales Ops responds with real-time coaching nudges. Finance observes aggregated patterns like missing Economic Buyer signals in a region and forecasts risk. Quarterly retrospectives identify which elements consistently predict churn or margin compression. We adjust calibrations. We refine playbooks. We evolve.

Mapping MEDDPICC to the Order-to-Cash Cycle

A frequent point of debate involves how MEDDPICC links to Order-to-Cash. I learned that when Paper Process triggers late in the cycle, DSO rises, working capital straits deepen, and customer satisfaction dips. That insight led us to integrate Paper Process into quote-to-cash tools which are early alerts when legal review exceeds threshold X, automatic renewal reminders tied to Economic Buyer profiles, and templated contract terms aligned to champion stakeholders. Thus, sales and finance blazed a path to reduced lag and cleaner revenue.

Decision-Making Under Uncertainty: A Personal Reflection

I recall a negotiation in which a prospect touted nonexistent Decision Criteria, while hiding the real blockers. My team flagged missing champion references and competitor signals. We propose a joint discovery workshop. We surfaced pain and Economic Buyer issues. We rewrote the deal. We won with a stronger alignment of economic value. That instance affirmed my thesis: MEDDPICC transforms ambiguity into structured insight. It converts intuition into evidence. It places decision-making under uncertainty into quantifiable frameworks.

Bringing Analytics and Data Science into Play

MedDPICC thrives when supported by data. I once led a project building a MEDDPICC completion score using logistic regression and deal outcomes. When that model hit statistical significance, we used it to triage deal reviews. We directed RevOps resources to the high-risk deals with missing MEDDPICC elements. We also tracked how completion correlated with win rate, velocity, margin, and likelihood to renew. This became part of the executive dashboards.

A Cultural Shift Toward Accountability and Transparency

Culture shapes systems. I facilitated executive forums where CRO, CFO, and Marketing heads reviewed MEDDPICC completion rates globally. We targeted regions with low Paper Process compliance or where Champions rarely surfaced. We discussed training, incentives, and tooling. We challenged teams to own qualification rigor as part of revenue accountability. We recognized reps who achieved near-perfect MEDDPICC with “badge” ceremonies. That recognition reshaped behaviors. Teams prided themselves on MEDDPICC discipline.

A Framework for Predictable Expansion

MEDDPICC supports not only initial bookings but also downstream expansion. When we identify Metrics early and secure Champions, we establish renewal anchors. When Economic Buyers know the contract, we smooth renewal cycles. When Pain is well-quantified, customers see value and expand. When Competition is mapped, upsell comes as stronger positioning rather than bargain cult. Thus, MEDDPICC fuels expansion and predictable revenue.

Integrating MEDDPICC into RevOps Infrastructure

Revenue Operations teams that excel have embedded MEDDPICC into playbooks, scoring engines, CPQ rules, CRM dashboards, and order systems. They link signals to reminders, escalate missing elements, and dynamically adjust forecasts. They derive insights for pipeline quality reviews. They connect qualification signals to cash cycles. They decode correlations between incomplete MEDDPICC and writedowns. They optimize workflows. And they close operational loops.

Emerging Trends: AI-Guided Qualification

I foresee AI becoming the next frontier of MEDDPICC optimization. Already, tools parse call transcripts to detect EBuyer mentions, track champion language, and flag competitor conversations. Natural-language understanding during calls surfaces missing Metrics or pain articulation. AI suggests next steps: “Ask who processes contracts” or “Probe deeper on budget owner.” These suggestive nudges will elevate teams from checklist compliance to AI-guided coaching. But success still depends on a culture that values disciplined qualification.

A Personal Commitment to Teaching and Scaling

I continue to teach RevOps leaders about MEDDPICC in workshops, webinars, and mentoring forums. I emphasize that it succeeds when leaders own it. An operations process without active leadership sponsorship becomes rituals without impact. I recount how I built shared dashboards with CROs and CFOs and held monthly reviews. I underscore how using MEDDPICC humanized forecast conversations because they now mean something. And when people ask me if their sales culture is ready for MEDDPICC, I say: if they embrace structured thinking, transparency, feedback, and learning, then they are ready tomorrow.

Final Reflection: Toward Revenue System Mastery

After thirty years, I see MEDDPICC not as another acronym, but as a maturity marker. It signals when an organization has moved beyond transaction to system. When teams do not just sell, they also design, estimate, adapt, and optimize. I see GTM becomes collaborative rather than siloed. I see with a smug smile that forecasting becomes forecasting, not guesswork. When expansion is engineered and not hoped for. And when every deal matters, which is not just for commission, but for enterprise resilience.